Dorota Strauch

Head of Research RBI Branch Poland, CEE Coverage Lead, Warsaw

The war in Ukraine, sanctions between the West and Russia amid unfolding energy challenges all have significant impact on economic developments and the outlook for the CE/SEE region. Our forecasts have been cautious from the beginning of the war assuming industrial or technical recession in the euro area and some CE/SEE countries, with the market consensus now having moved close to this view. The data released in the last months seem to confirm this scenario while making it now not a pessimistic one but rather realistic with new challenges ahead and therefore more negative scenarios likely. On the inflation side, the economic challenges still do not allow concerns about inflation to ease with the indicators in CE/SEE countries still reaching new highs even if peaks seem near. Energy prices remain a key concern ahead of the winter season while governments pursue anti-inflationary measures that seem increasingly likely to be prolonged or extended in scope.

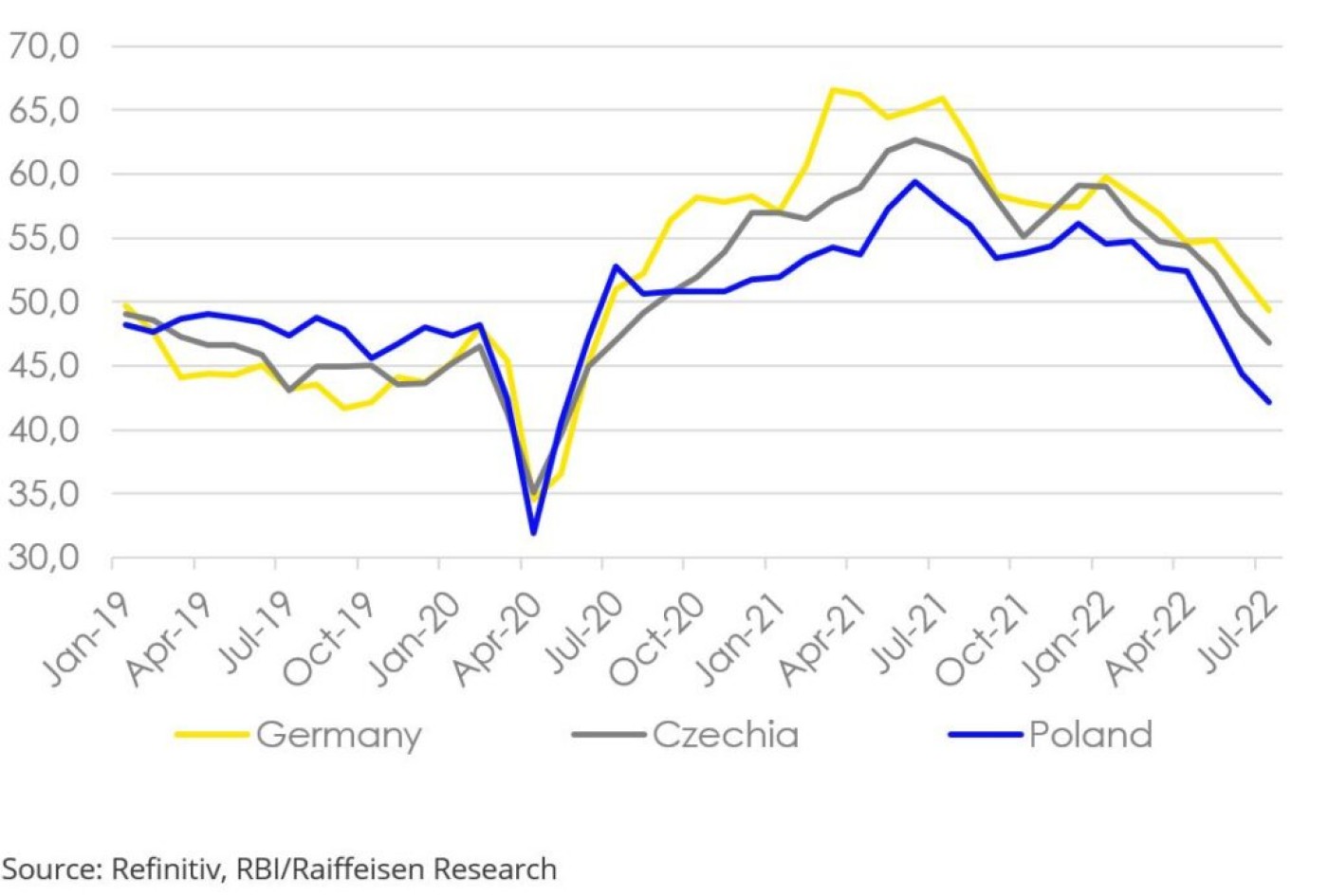

Manufacturing PMIs in Central Europe (CE) pointing to a contraction of activity.

From the onset of the war in Ukraine our assessment was that the industry-reliant Central Europe (and to some extent Romania) is more vulnerable to the consequences of these events. This has been confirmed by the decline in Manufacturing PMIs and ESI indices observed in the last months. In the case of Southeastern Europe, the economic downside is somewhat limited due to less exposure to the industrial sector compared to Central Europe. Instead, the region is more reliant on services, in particular tourism, which limits the slowdown of the economies amid the strong summer season. This has also been confirmed lately by the surprisingly good Q2 GDP data from Croatia with yoy growth accelerating and reaching 7.7% yoy (2.2% qoq, vs 7% yoy in Q1). This clearly contrasts with Poland where growth slowed to 5.3% yoy (-2.3% qoq) from solid 8.5% yoy in Q1. It should be stressed that Poland was a negative outlier in the CE/SEE universe with a qoq decline in GDP. However, in annual terms also other CE countries saw declining growth rates which in Q2 came at 6.5% yoy in Hungary and 3.6% yoy in Czechia.

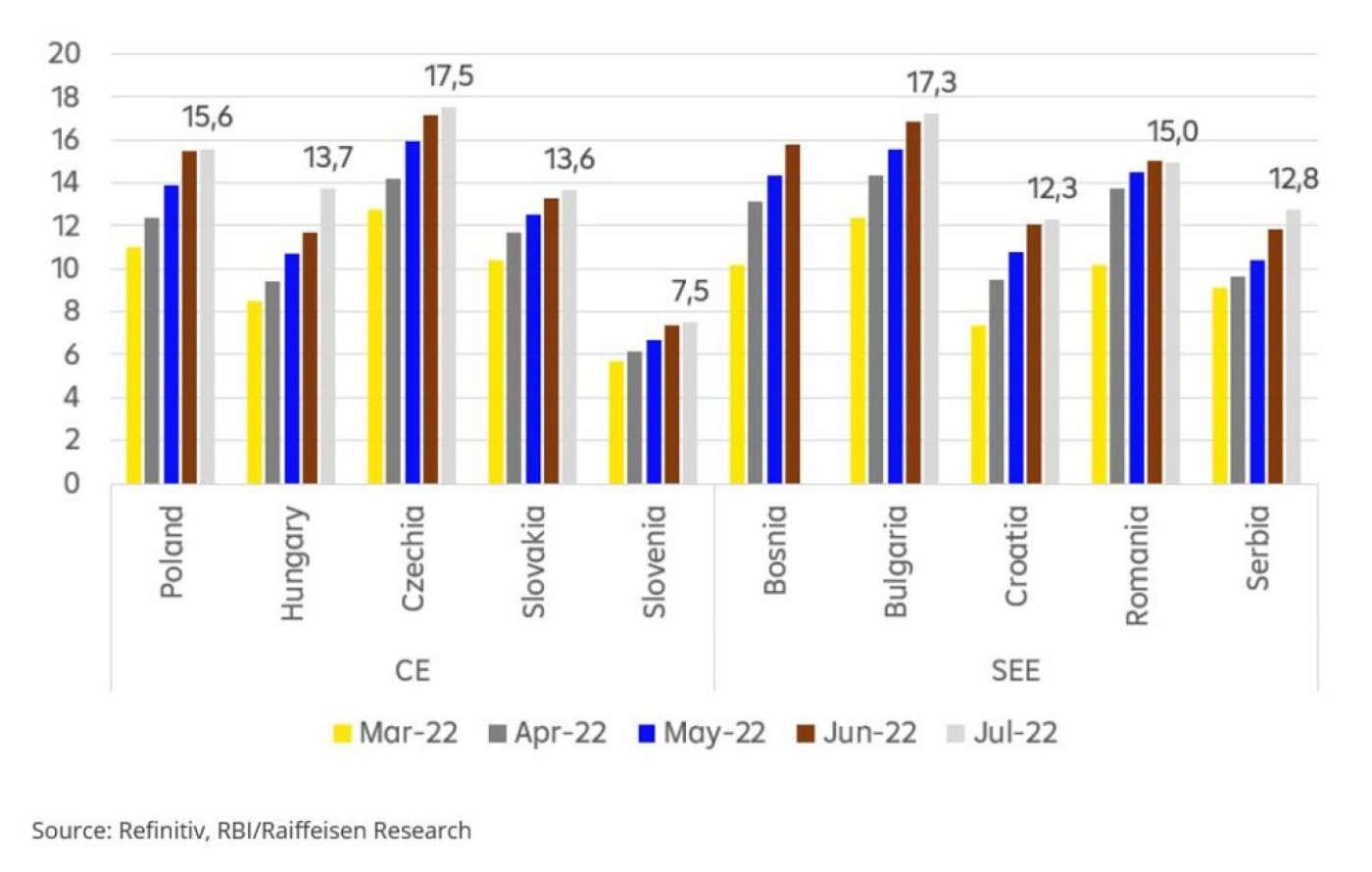

At the same time, high inflation is affecting demand in both Central and Southeastern Europe, as the share of food and energy in disposable income is relatively high compared to Western Europe. Elevated inflation in the next quarters will continue to dampen consumer demand.

On the positive side, Next Generation EU (NGEU) funds will boost growth in the medium term, supporting a shift in GDP to more investments, and less consumption. Near-term challenges may however slow absorption of the funds amid overall challenges to their effective use visible in previous EU budgets.

Recent readings still show a continued rise in inflation, and the highest pressures still in Central Europe plus Romania and Bulgaria. In some countries, the consumer price index may soon reach (or has already reached) its highest level for the year, but this is still subject to significant upside risks given the ongoing pressure from energy prices in particular. As a result, while we see less room for upside surprises in the next months, it is too soon yet to see a durable retreat to much lower inflation levels.

In the medium term, the looming economic slowdown will make it harder for companies to pass on higher costs to consumers, who are already struggling with a decline in disposable income. As a result, inflation is expected to decline in 2023, but remain at a high level by historical standards. This easing should be visible especially for the core inflation while upside risks remain for energy and food prices.

Another factor contributing to the uncertainty of inflation forecasts is the measures taken to contain inflation. In recent months, government policy packages have also been announced in the Czech Republic (which has been the most reluctant to introduce such solutions), while the introduction of measures in Bosnia and Herzegovina continues to be hampered by political challenges, which recently pushed inflation in Bosnia and Herzegovina above 14%. As challenges increase ahead of the winter period (along with gas prices), many countries in the region are expected to prolong and expand their anti-inflation measures.

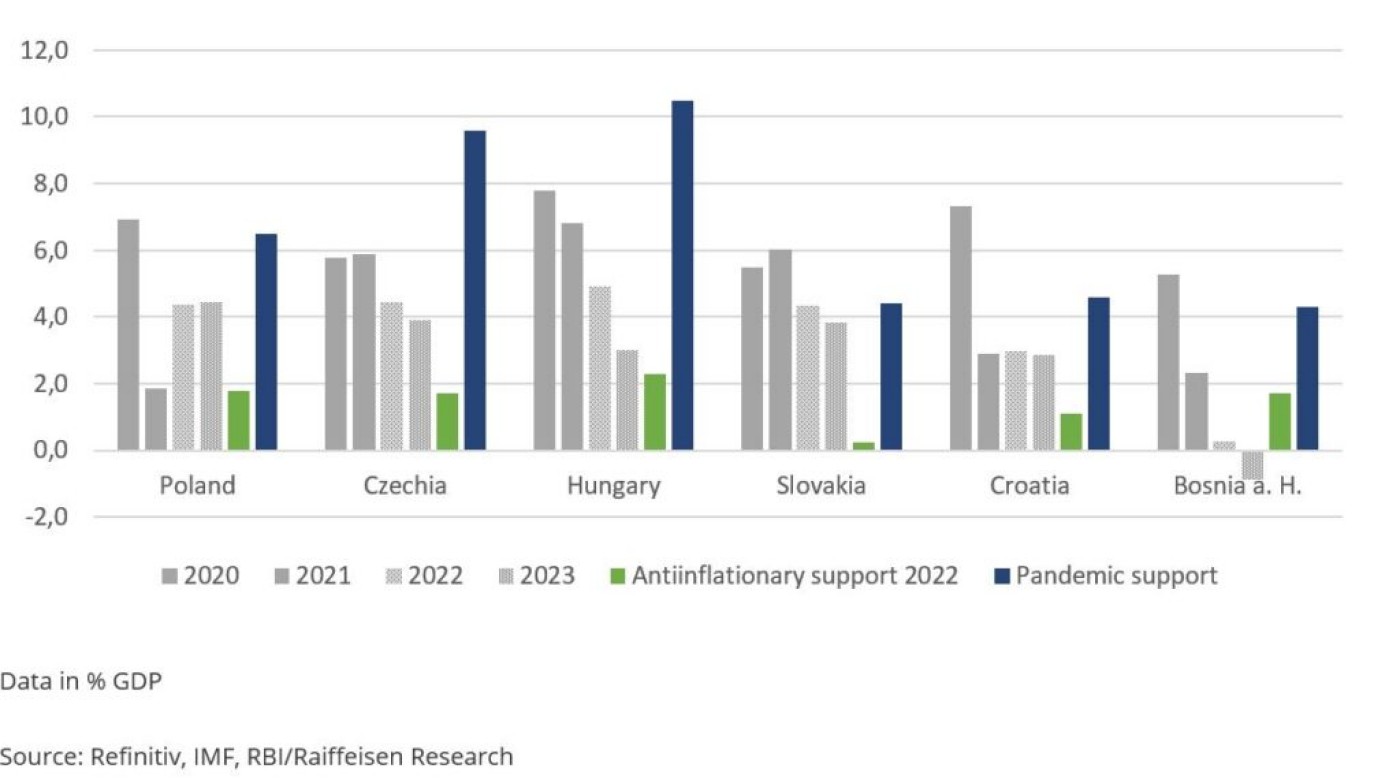

As can be seen from the above graph, anti-inflationary shields in some countries are significant and exceed 1% of GDP, but are still not comparable to the direct support during the pandemic. In addition to measures directly related to energy and food prices (tax cuts, price caps), the current support is enhanced by other measures such as child benefits (Czech Republic, Austria), higher pensions (half of the recently announced support package in the Czech Republic) or the loan holidays introduced in Poland.

The key thing about the measures implemented is that in most countries they are concentrated on the most vulnerable groups of the population, who spend a larger share of their income on increasingly expensive energy and food. This seems to be the most sensible solution, as measures that are too broad can have counter-effects by providing additional demand impulse and thus making it more difficult to contain inflation permanently. However, Poland is the only exception where the measures are rather broad-based than focused on vulnerable groups. For that reason, it is also the only country in CE/SEE where we project higher fiscal deficits in 2022 and 2023 compared to last year. The ratio of 4.4% of GDP for both years does not seem very high in regional comparison (especially in CE), as the deficit in 2021 declined significantly due to the rapid recovery. Nevertheless, it is a very pronounced shift towards a more expansive fiscal approach, which also contributes to the challenges of containing inflation. The political context is worth mentioning here, as Poland is due to hold parliamentary elections in 2023, which also pose the risk of an even more expansionary approach in the near future. On the other hand, the political motivations do not seem to accelerate anti-inflationary support in Bosnia and Herzegovina where measures were announced in early 2022 but have still not been introduced amid political stand-offs (we expect them to be approved in September).

In Czechia, the government came up with a sizeable support package (approx. 1.7% of GDP) lately to help ease the price burden carried by households. It is crucial that the assistance is made accessible, as data show that so far only a fraction of households eligible for government support actually use it.

In Hungary on the other hand, amid new measures aimed to consolidate public finances, one of the recently announced changes was the limit to the freezing of electricity prices for households which had been in place since 2015. After the change, from September 2022, above average gas and electricity consumption should be paid at market price.

As mentioned above, the scale of the measures risks making the fight against inflation less effective. Additional funds are provided to maintain demand for energy (including that imported from Russia) instead of reducing dependence and lowering demand for fossil fuels. Meanwhile, direct compensation while still boosting the overall demand may actually direct it elsewhere (to new energy sources or prompt a reduction in demand for energy while leaving the households with funds that can be spent on other goods/services ).

The still-unfolding economic slowdown and challenges related to energy supplies, high inflation, and the war in Ukraine keep the focus now more on dealing with those issues rather than on accelerating the post-pandemic fiscal tightening. While we do not forecast a reversal in the fiscal consolidation path, the elevated expenses on anti-inflationary or other anticrisis measures should be targeted at the most vulnerable, as well as combined with a more prudent approach in other areas of public finances. This is crucial in order not to raise vulnerability to any increase in fiscal scrutiny which is very likely to return once the current challenges are addressed.

Head of Research RBI Branch Poland, CEE Coverage Lead, Warsaw

Do you also have a travel tip, a recipe recommendation, useful business customs, interesting traditions or a story about CEE that you would like to share? Write to communications@rbinternational.com and share your experience.