Zrinka Zivkovic-Matijevic

Head of Economic Research Department at Raiffeisenbank Austria d.d. Zagreb

Croatia is the 20th and most recent addition to the euro area. In this interview, Zrinka Živković-Matijević, Head of Economic Research Department at Raiffeisenbank Austria d.d. Zagreb, sheds light on Croatia's motivations behind adopting the euro as its currency and discusses the obstacles the country faced on its path to joining the euro area.

Zrinka Živković-Matijević: Certainly. Croatia had a strong desire to introduce the euro as soon as possible for

several reasons. First, the country had a historically high level of euroization in its economy, meaning that the euro was widely used and held by individuals and businesses even before joining the euro area. Additionally,

Croatia relies heavily on tourism and many of its major trading partners already share the euro as their currency. By adopting the euro, Croatia aimed to reduce currency risk and enhance economic stability. However, the path towards euro adoption was not without its challenges.

Croatia encountered several obstacles on its path to euro adoption. One significant challenge was the poor institutional framework and public finances, which needed to be addressed before further progress could be made. The country also faced the aftermath of a deep recession that lasted almost six years and was largely due to accumulated debt in various sectors. It took years for Croatia to deal with this issue and reduce its external vulnerability. Additionally, Croatia had a high exposure to the euro, as most domestic sectors had unmatched currency positions in their assets and liabilities, which posed a constant FX risk. Overcoming these obstacles required careful management of economic policies and structural reforms.

The introduction of the euro brought both benefits and challenges to the Croatian economy. On the positive side, it eliminated currency risk, reduced the risk premium and increased liquidity in the domestic market by lowering regulatory costs for domestic banks. These factors contributed to the delay and mitigation of the inevitable growth of interest rates in the domestic market. However, there were also challenges. Croatia introduced the euro during a period of supply shock and high inflation both domestically, and in the euro area. The fear that the euro itself would cause higher prices proved unfounded. Research conducted by the Croatian National Bank and the European Central Bank indicated that the impact of the euro changeover on consumer prices in Croatia was relatively small, amounting to 0.4 percentage points. Inflation convergence will continue over time and may depend on factors such as the liberalization of administratively regulated prices.

Generally, support for the euro increases after a country joins the euro area, and Croatia is no exception. For many years, the German mark and later the euro symbolized security, stability and a developed and orderly world, which Croatia aspired to. Trust in European institutions in Croatia has consistently been higher than trust in local institutions, political parties, and national authorities. Moreover, Croatia's savings and loans were already in euros or euro-denominated, so the loss of monetary sovereignty did not trigger negative emotions for many people. Instead, it presented Croatia with an opportunity to achieve real convergence and benefit from the stability of the euro.

Croatia has made significant progress in terms of real convergence towards the euro area in recent years. Its GDP per capita, which was around 55% of the euro area average in 2012, reached slightly over 70% in 2022. However, sustainable, and lasting growth requires increased productivity and competitiveness. To accelerate real convergence, Croatia needs to implement structural reforms, particularly in the public sector. Strengthening

institutional capacity and the rule of law will also play a crucial role in driving economic growth. By joining the euro area, Croatia has gained the opportunity to represent the interests of a small country within a prestigious

society, and it has strengthened its geopolitical position.

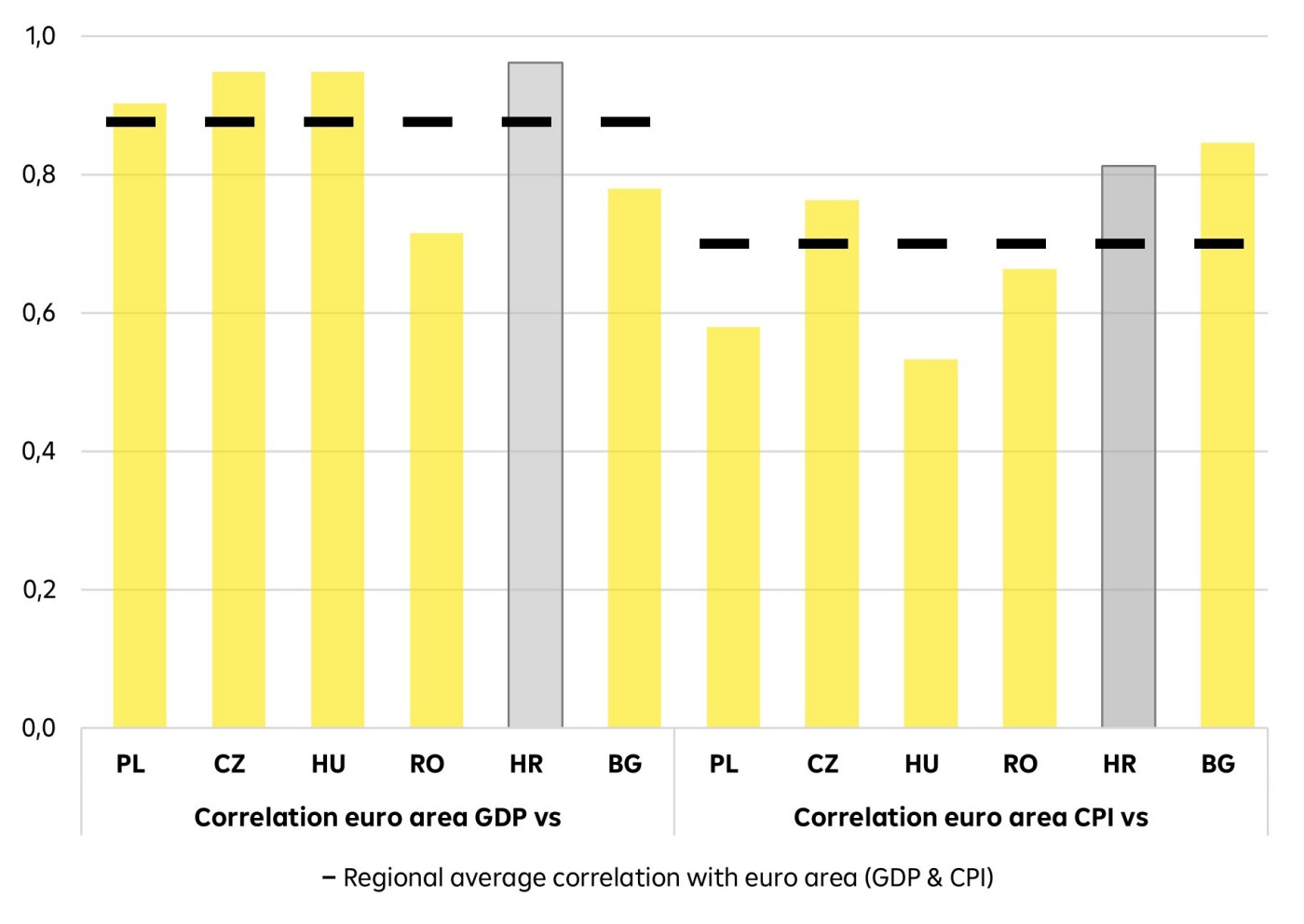

Eurostat, ECB, RBI/Raiffeisen RESEARCH

I believe that the introduction of the euro in Croatia represents a significant opportunity for the country's economic stability, growth, and further integration into the European Union. While challenges remain, implementing the necessary reforms and leveraging the advantages of euro membership will be key to Croatia's success. The ongoing process of real convergence and the continued support for the euro in Croatia are positive signs for the country's future prospects.

Head of Economic Research Department at Raiffeisenbank Austria d.d. Zagreb

Do you also have a travel tip, a recipe recommendation, useful business customs, interesting traditions or a story about CEE that you would like to share? Write to communications@rbinternational.com and share your experience.