Zrinka Zivkovic-Matijevic

Head of Economic Research Department at Raiffeisenbank Austria d.d. Zagreb

The latest Convergence Report has confirmed our expectation that (only) Croatia met the necessary preconditions to adopt the euro on 1 January 2023, thus bringing the number of euro area Member States to twenty. Bulgaria is to remain in the waiting room as the assessment concluded a lack of legal compatibility and failure to fulfil inflationary criteria, which will not be easy to overcome, given the latest political developments in the country.

At the beginning of June, the European Commission and the European Central Bank published the Convergence Report, which describes the headway made by non-euro area Member States to comply with the criteria necessary for adopting the euro. It is a crucial document, especially for Croatia, as it represents the final assessment and (in)direct confirmation of whether Croatia is becoming the 20th member of the monetary union as of 1 January 2023.

Based on the conclusions of the Convergence Report and after consulting with the European Parliament, the Council will determine whether Croatia meets all the conditions for euro adoption. The final, and in our view positive, decision is expected to be delivered in the first half of July (probably on 12 July). On this occasion, we also expect the parity rate as set when entering ERM2 to become the conversion rate.

While the process of joining the EU took a rather long time (almost eight years), it is now quite certain that the process from joining ERM2 to adopting the euro as the single currency took only 2.5 years.

Already at the end of March, it was clear that Croatia had fulfilled the post-entry commitments as an additional criterion to the already known legal and Maastricht criteria. Under the watchful eye of the HNB and without any significant intervention on the market, EUR/HRK has proved its stability – even during the COVID-19 crisis peaks. Fiscal metrics saw significant improvement in 2021 due to strong economic growth while interest rates widely priced solid economic developments, sovereign credit rating upgrade and eventually the euro area entry in 2023. However, as months passed, complying with the inflation criteria has become increasingly challenging. Nevertheless, in line with the expectations, European institutions identified Malta and Portugal (countries with the lowest inflation) as outliers and therefore excluded them from the calculation of the threshold, which finally stood at 4.9% yoy. With a 4.7% yoy 12-month average inflation rate, Croatia fit in well and fulfilled the criteria.

Otherwise, with regard to one of the most challenging areas – public finance – just like all other member states, Croatia has remained in a comfortable position because the general escape clause of the Stability and Growth Pact will remain active until at least 2024. Nevertheless, 2021 already brought strong fiscal consolidation, as the budget deficit narrowed below 3% of GDP and the public debt to GDP ratio dropped significantly (by 7.5 pp). In the long run, we see public finances and institutional quality as the most challenging and demanding in the process of achieving real convergence of the Croatian economy.

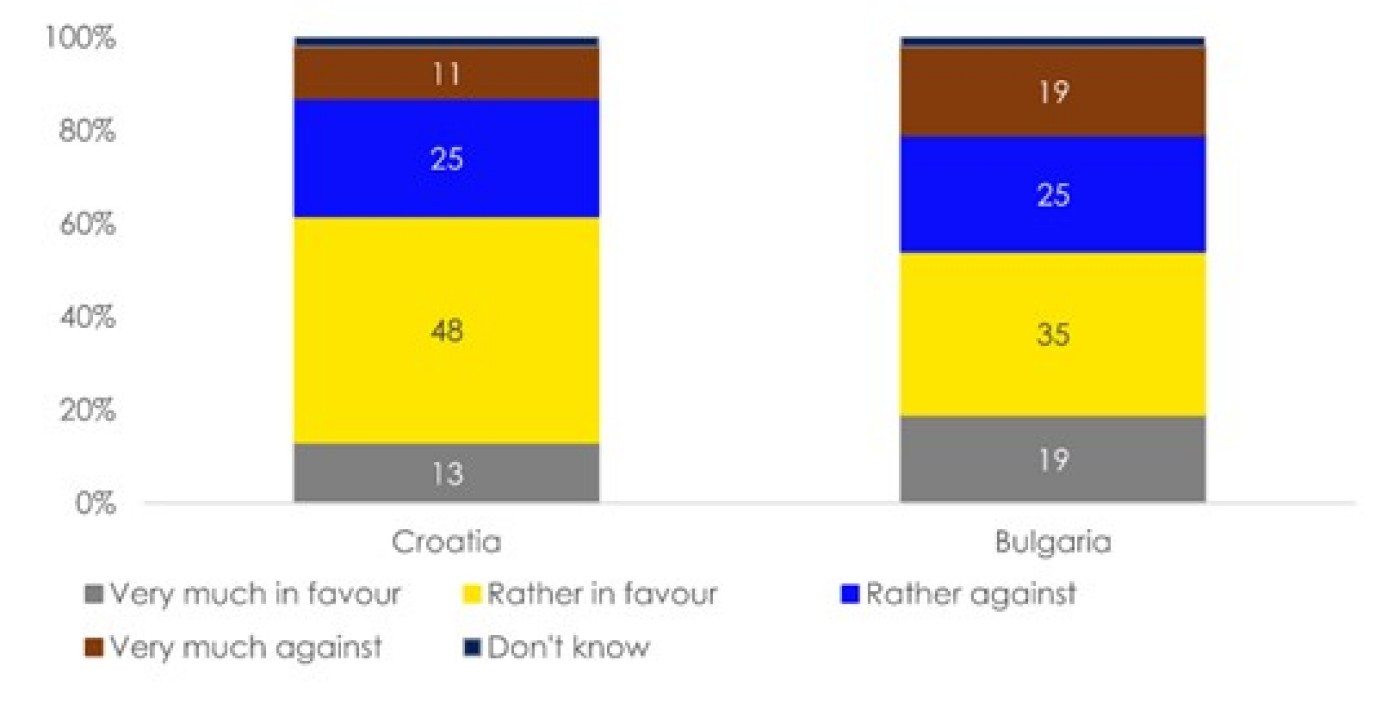

Source: EC, Eurobarometer, RBI/Raiffeisen Research

Unlike Croatia, Bulgaria, which also joined ERM2 in July 2020, remains in the lobby as the normative criteria as well as post-entry commitment and legal alignment have not yet been met. In Bulgaria the euro topic has been rather occasional. Accordingly, the efforts on it were not a subject of any well-thought and consensual strategy, nor were they intense. As a result, the needed strong and focused political commitment to the euro accession was not demonstrated. In this sense the findings of the convergence reports are logical and expected.

Additionally, after the accession of both countries to ERM 2 in July 2020, Bulgaria entered a period of strong political turbulence: protests, elections, caretaker cabinets, etc. Thus, the country lost at least a year in which it did almost nothing concerning the euro adoption. In early June, the government published a plan for the euro introduction, which is a technical document regulating the logistics around the changeover to the euro. However, there was no clear consensus in the four-party coalition on its implementation, and after the latest split in the ruling coalition, with a minority government in charge, the implementation will become even harder.

The convergence reports rightly state that Bulgaria does not meet the criterion of price stability. In addition, the country is required to make some legal amendments related to central bank independence, as well as some other technical issues. All these points have been known for years and can be cleared up quickly with political will. Thus, the economic problem area practically remains the CPI. Its average for the twelve months to April 2022 was 5.9% and is above the reference value of 4.9%. Although there are some tools to curb inflation, it should be emphasized that in a currency board system the country cannot use the tools of the classical monetary policy. In our opinion, this situation should be properly communicated to the ECB and an understanding would be gained.

In addition, structural reforms to improve the business and institutional environment are crucial for Bulgaria. These include significantly reducing corruption, ensuring an independent and efficient judiciary, and improving the education system. The government is working on these issues, but due to the TISP party leaving the ruling coalition, the government is dependent on opposition parties for any significant progress on these matters. Ultimately, the adoption of the euro is in the hands of the government. If it takes the necessary steps, Bulgaria could still adopt the euro on January 1, 2024.

In conclusion, due to the political readiness, political stability and strategic commitment to the criteria, Croatia has progressed towards its aim of euro accession much faster than Bulgaria. Therefore, Croatia is set to adopt the euro as early as January 2023, whereas the still necessary reforms mean that Bulgaria will remain in the waiting room until at least January 2024, but likely even longer, given the developments in the political environment in Bulgaria.

Thus, this time Croatia outperformed Bulgaria in contrast to EU accession (Bulgaria 2007 vs. Croatia 2013), which can be seen as a slightly positive signal regarding political developments in Croatia. This also applies to the fiscal policy stability orientation of recent years – although Bulgaria is also well positioned here. And even if certain core political personalities have worked very strongly in the direction of euro accession in case of Croatia, there was an overall broad political consensus (incl. in relevant authorities and ministries) in this direction. Moreover, the EU and the Eurozone have shown themselves capable of enlargement even in difficult circumstances. Furthermore, relevant criteria have been interpreted in a targeted manner, with sufficient flexibility under special circumstances. We consider this a political success not only for Croatia, but also for the EU. The EU and the EU institutions have thus shown themselves capable of acting in crises. After all, the Eurozone is being expanded – also a geopolitical signal – in the context of the Ukraine war and unseen inflation challenges in Europe. The foundation for this enlargement was laid by the ERM-II entry back in 2020 in the context of the COVID-19 crisis.

Head of Economic Research Department at Raiffeisenbank Austria d.d. Zagreb

Head of Research Department at Raiffeisen Bank Bulgaria

Head of Research RBI AG in Vienna

Do you also have a travel tip, a recipe recommendation, useful business customs, interesting traditions or a story about CEE that you would like to share? Write to communications@rbinternational.com and share your experience.