Gunter Deuber

Head of Research RBI AG in Vienna

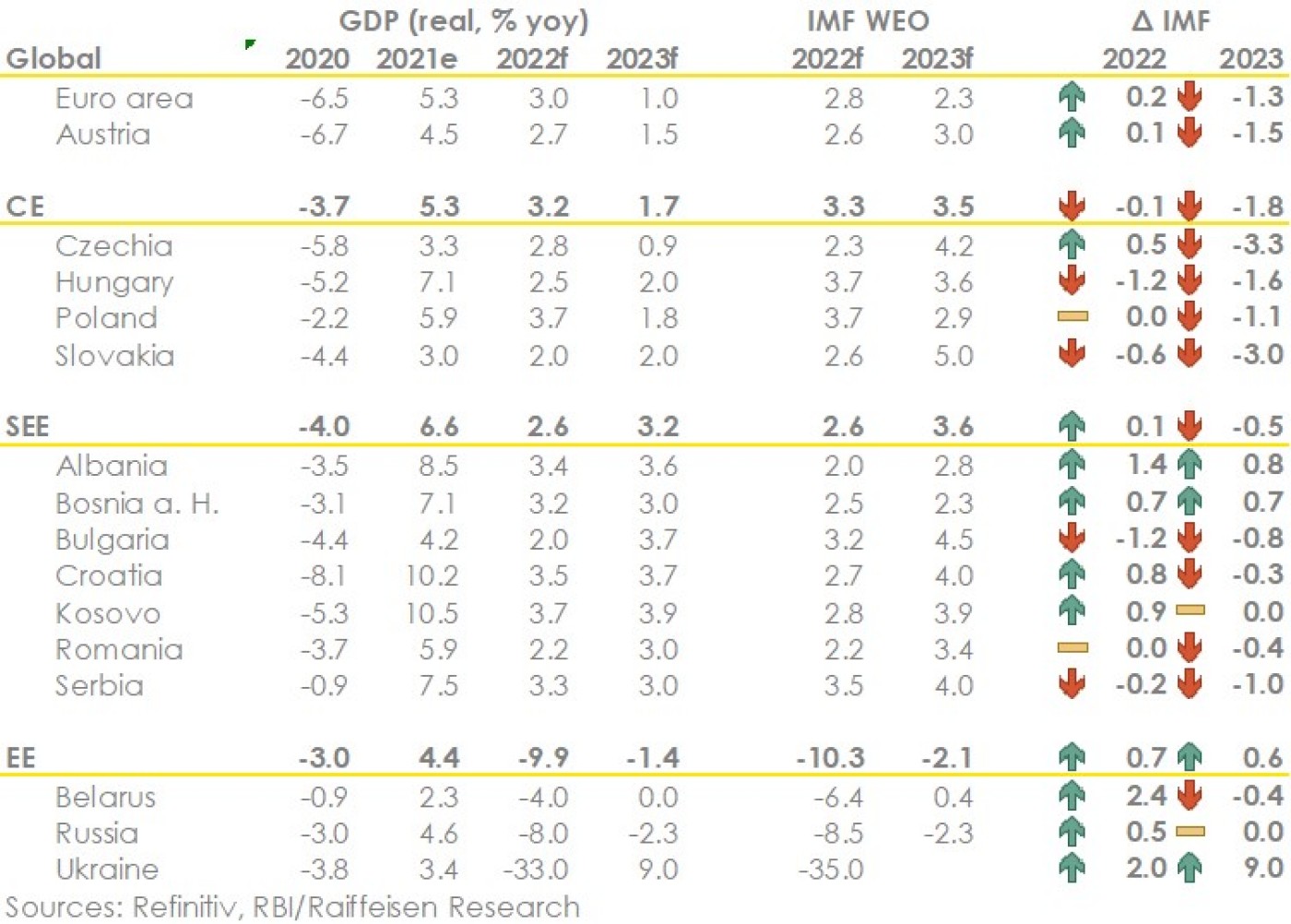

The war in Ukraine, the sanctions and countersanctions it has spurred, price pressures not seen in decades and supply chain disruptions re-emerging have urged Raiffeisen Research to move to a more conservative scenario for 2022 and 2023. Other institutions (for instance the IMF) also switch to more conservative projections, although not yet as decisively as Raiffeisen Research. Overall, we see Europe and especially Central and Southeastern Europe (CE, SEE) facing a difficult economic outlook in the coming 12-18 months. We could be heading for the lowest economic growth since the euro crisis of 2012/2013, not counting the deep Corona recession. And this is likely to go along in Central and Southeastern Europe with the highest inflation rates in decades. The latter will possibly have a stronger negative growth impact than in Western Europe. Policy measures to curb or stretch price growth are already in place and are much needed in most CE/SEE countries. From a macroeconomic perspective, it is also important that the banking sector in the region is in a much better position than in the aforementioned euro crisis period – which should facilitate macroeconomic stabilisation. Moreover, EU institutions and the ECB are now clearly actively taking their responsibilities beyond the euro area as also shown by the recent extension of swap lines, the NGEU-instrument as well as the Investment Plan for the Western Balkans.

Even though the economic and financial sanctions against Russia cover ever more aspects of economic linkages and will likely include broader sanctions on energy products at some point, the impact on GDP growth in the rest of Europe will likely remain limited. Although there is a myriad of factors at play, some key factors reveal that the conflict (and the related sanctions) should not hamper economic growth too dramatically — outside of Eastern Europe. Firstly, the direct economic linkages between Russia and the CEE region are rather limited, partly also due to Russian isolationism in the recent past, although energy dependence remains a crucial issue for the euro area and CEE, as was underlined by the cut-off of Poland and Bulgaria from Russian gas. Secondly, the solid global economic outlook will also be of support, as key economies (i.e. the US and China — although the latter is hampered by a new wave of Covid-19) are even less affected directly by this war and are still expected to show reasonable growth.

In Central Europe, the major impact on growth will come from the diminished domestic demand due to the comparatively high inflation levels (more on that below) strongly affecting disposable household income and the supply shock affecting industrial output. The disruptions to industry stemming from the bottlenecks in energy supplies will likely slow down economic growth, particularly in the winter of 2022-2023. Mitigating the poor start to the 2023, next year will be positively impacted by the inflow of funds via the NextGenerationEU fund, which should support investments, despite the likely prolonged industrial weakness. The direct impact on Southeastern European economies is even less pronounced than in CE, as most countries (except Bulgaria) have even more limited economic linkages with Russia and lower dependency on Russian energy imports (again, except Bulgaria). With the recent cut-off from Russian gas, the Bulgarian economy will, therefore, suffer strongest, reducing growth to around 2.0% yoy, as sourcing the gas from different countries comes with a significant price increase and short-term interruptions in industry cannot be ruled out completely. For the region as a whole, the strongest additional impact will come from a decrease in private consumption, mainly caused by the even higher inflation, but also due to lower growth in the euro area and smaller flows of remittances. However, some countries in the region, i.e. those not benefitting from the NGEU funds, might see a reduction in private investments, which are pressured by the high uncertainty. The Eastern European region will obviously suffer the strongest from the war. Besides the needless devastation inflicted on Ukraine, the self-inflicted damage to the Russian economy and consequences for Belarus will push the entire region into a deep economic crisis. In case of Russia, we expect a deep and protracted recession, along the lines of a “L-shaped” stagnation scenario.

Green arrow: RBI more optimistic, red arrow: RBI more pessimistic

Similar assumptions are shared by the IMF, which published its fresh global forecasts, incl. projections for the CEE region. Overall, the IMF has lowered its growth expectations — as expected — and raised inflation forecasts, while in numerical terms we consider the IMF’s overall scenario for CE to be somewhat brighter than our baseline scenario. With regard to the Russian economy, it seems that the IMF is sharing our view of a “relative resilience” of headline GDP numbers in 2022 (mind the still good start into the year and current strong export dynamics), while the Fund also expects a protracted recession (i.e. two consecutive years of recession) as we do. For the Ukrainian economy, the IMF is just slightly more downbeat than our current 2022 GDP call (-35% vs. -33%). Regardless of the concrete outcome the numbers underline that the war in Ukraine has reached a level of escalation that goes well beyond what we have seen in modern conflict history in Europe (e.g. Georgia, Balkans).

However, we have to stress that some further frictions to EU-Russian economic and energy relation are to be expected – although we would not expect a complete termination of gas deliveries. The most recent delivery frictions in case of Poland and Bulgaria are possibly an indication that Western Europe should not easily rely on the fact that we can simply reduce energy relations with Russia on our own terms and in a well-planned manner (incl. non-payments in RUB) — as Poland has done (or tried to do). In this sense, it is essential to point out that our economic baseline scenario already includes some further frictions in the economic relations between the EU and Russia, which are, unfortunately, almost certainly unavoidable. Moreover, the latest escalation calls into question the fact that Russian and Western European gas flows also run apart from system competition — as in the Soviet times and also crises back then.

The war in Ukraine led to another wave of price increases in energy and other commodities incl. agricultural. While some of the increases may (or already have been) reversed to a limited extent, our new scenario assumes a prolonged impact, possible renewed price pressures and, therefore, no durable return to lower prices within the next quarters.

Moreover, as we observe new sanctions and countersanctions between Russia and the West, which may intensify, the supply channel is another source of upside price pressures. Adding to this are the consequences of the war on Ukrainian exports (agricultural in particular) as well as factors beyond our region like the recent pandemic developments in China (which may again put the supply-chains under pressure from this side).

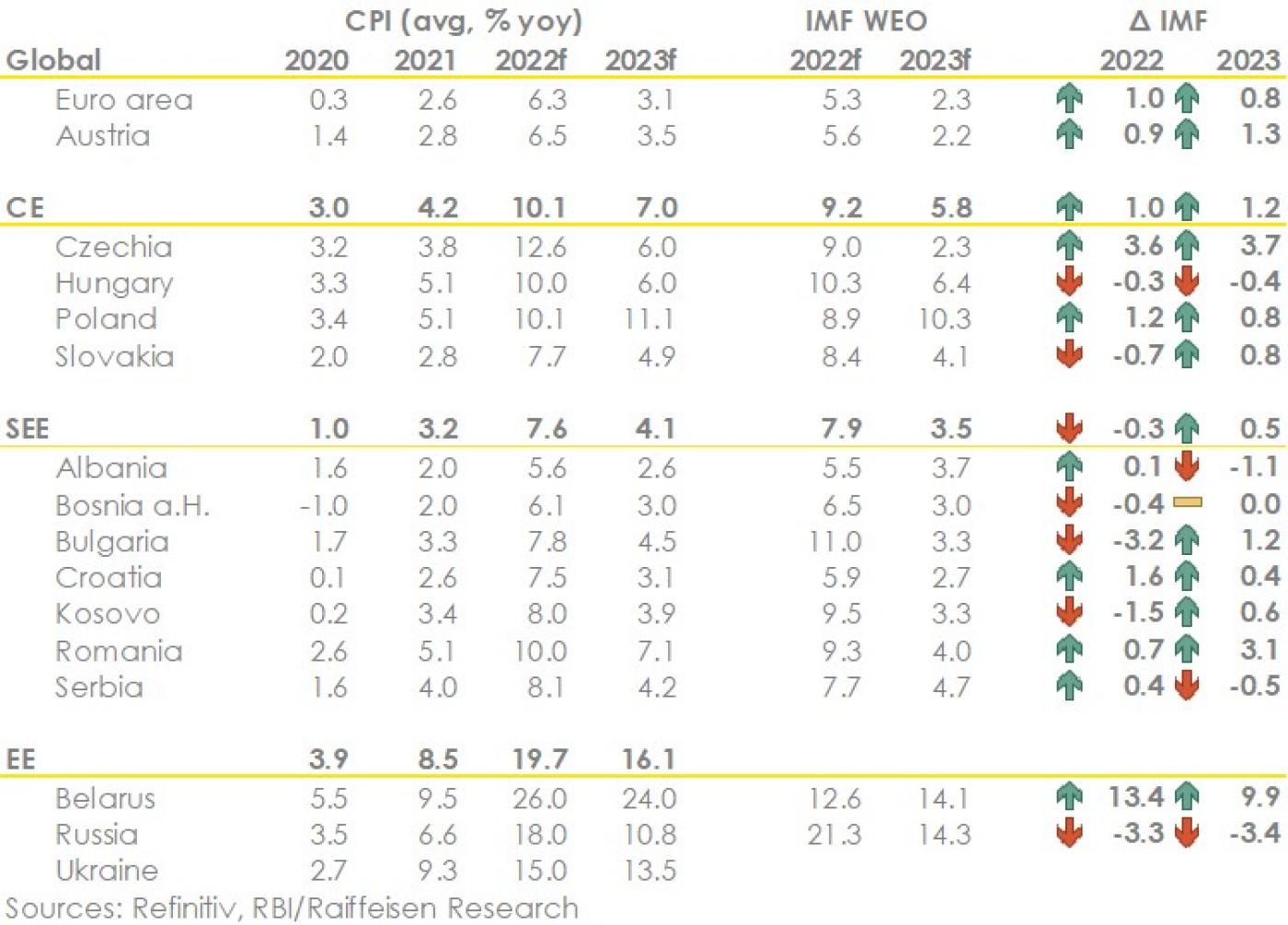

All in all, this led us to increase our inflation forecasts, both for the euro area and CEE. The additional price pressures will surely result in more government policy responses to limit the impact – to households above all. In the euro area, government measures may take the form of financial aid and/or compensation to consumers, which will create further inflationary pressure in late 2022 and 2023. The high energy prices (double-digit) should decline in 2023 amid fading low base effects. However, more durable price increases are set to be observed in food prices and core inflation which may stay above the historical average also in 2023.

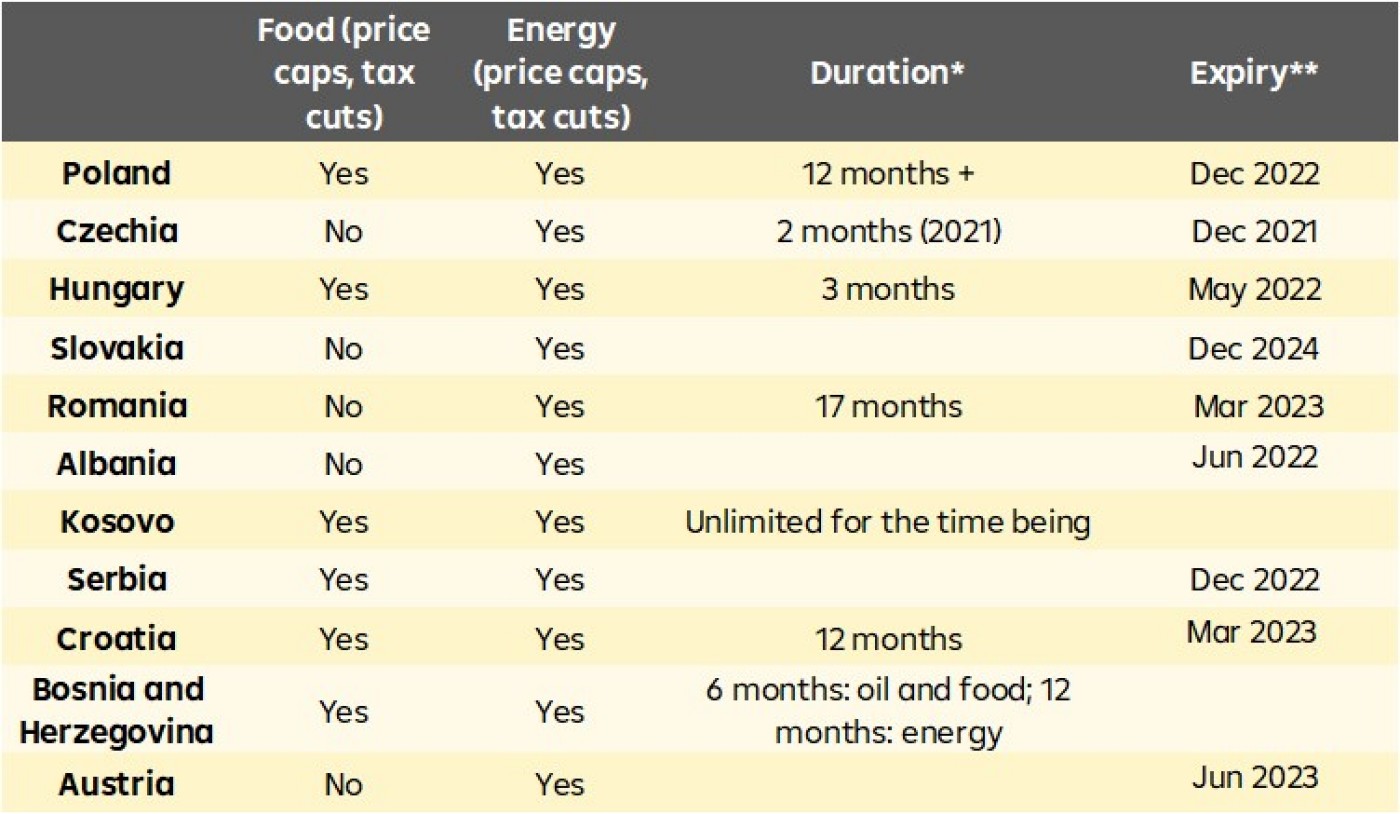

* Rough estimate of duration of the measures as they are implemented in varied timeframes depending on measure

** Expiry of all temporary measures

In CEE multiple anti-inflationary government measures (on energy, food items) have been taken in the last months and continue to be introduced, where the heterogenous approach also leads to a slightly differentiated inflation outlook for 2022-2023. In particular, in CE the most pronounced temporary measures were taken in Poland, which will dampen 2022 CPI only to a limited extent, whilst also lifting our 2023 estimate amid a low base effect. Interventions are also made in SEE, more often extended to food products than in CE, although measures here have been relatively less pronounced (limited to fuel or basic items, lasting 3-6 months). As a result (with the exception of Poland) our forecasts assume a lower average CPI in 2023 than this year, however, the 2023 estimates remain at elevated levels compared to historical values. Of course, the largest price increases will be observed in Eastern Europe amid direct consequences of the war in Ukraine and sanctions against Russia. This leads to estimated double-digit inflation numbers in these countries with little easing assumed for 2023 and ongoing upside risks.

Such expectations are also shared by the IMF, as revealed by the fresh WEO. While also historically high, the IMF inflation forecasts tend to be lower for 2023, possibly due to less harsh expectations in terms of sanctions going forward. The difference may also result from our assumption of a long-term higher inflation path which we expect to be above the historical values.

Green arrow: RBI more pessimistic, red arrow: RBI more optimistic

The banking sector in the CE/SEE region is entering the more challenging economic outlook on a solid footing. As of year-end 2021, NPL levels in CE/SEE banking sectors are as low as they had been prior to the Global Financial Crisis (~3%) and the lowest over the last decade. Moreover, lending standards have been prudent in recent years. Hence, no deterioration like in the aftermath of the Global Financial Crisis and in the context of the euro area crisis shall be expected for NPLs in CE/SEE (maximum at close to 12% in 2013). Moreover, in the short term, further rate hikes plus elevated key interest rate levels are supportive for the profit outlook. However, on some markets yield curves are already inverted, which bodes less well for the banking environment. In sum, we expect a somehow similar picture (to some extent) over the next 12-24 months as seen in 2013 or 2015, where profitability in the CE/SEE banking sectors came under pressure in the context of the euro crisis. Nevertheless, for the aggregate banking sectors in CE/SEE we see a Return on Equity in the range of 10%+ within reach. Not to forget that we see less hard one-off adjustment costs compared to the situation a decade ago, also due to more sustainable lending policies (incl. Less lending in foreign currencies). See also our recent Banking Sector Outlook note.

Head of Research RBI AG in Vienna

Head of Research RBI Branch Poland, CEE Coverage Lead, Warsaw

Professional Economic Analyst, RBI AG, Vienna

Do you also have a travel tip, a recipe recommendation, useful business customs, interesting traditions or a story about CEE that you would like to share? Write to communications@rbinternational.com and share your experience.

Do you also have a travel tip, a recipe recommendation, useful business customs, interesting traditions or a story about CEE that you would like to share? Write to communications@rbinternational.com and share your experience.