Zrinka Zivkovic-Matijevic

Head of Economic Research Department at Raiffeisenbank Austria d.d. Zagreb

Slovenia, a small, open and export-oriented economy will report a broad-based and still robust economic growth in 2022. This Central European country with a population of just over two million was the first “new member state” to adopt the euro back in 2007. Along with Czechia, and despite the somewhat slower growth dynamics in recent history, Slovenia is still one of the most developed countries of the “new Europe”. Coping with the inflationary pressures currently seems the most demanding issue for the new government, but there is another challenge waiting around the corner: economic slowdown.

The regular parliamentary elections, held in April, brought a surprise to the Slovenian political scene. The winner was the newly formed Freedom Movement Party led by political newcomer Robert Golob, who is known as the former CEO of a state-owned energy company. His party received a third of the votes thus securing 41 seats out of the 90-seat in Parliament. On an interesting note, this is the largest number of parliamentary seats won by one party in recent Slovenian history. Golob’s party, the Freedom Movement, formed a three-way centre-left coalition with its left partners, Social Democrats and the Left thus securing a stable majority in the parliament as it has 53 of the 90 parliamentary seats. Early in June, the parliament approved the new government with Mr. Golob as Prime Minister. The new government coalition is expected to have a more pro-EU stance. The task upon new government is anything but easy, especially in an environment of high uncertainty, rising inflation and an inevitable slowdown of economic activity across Europe.

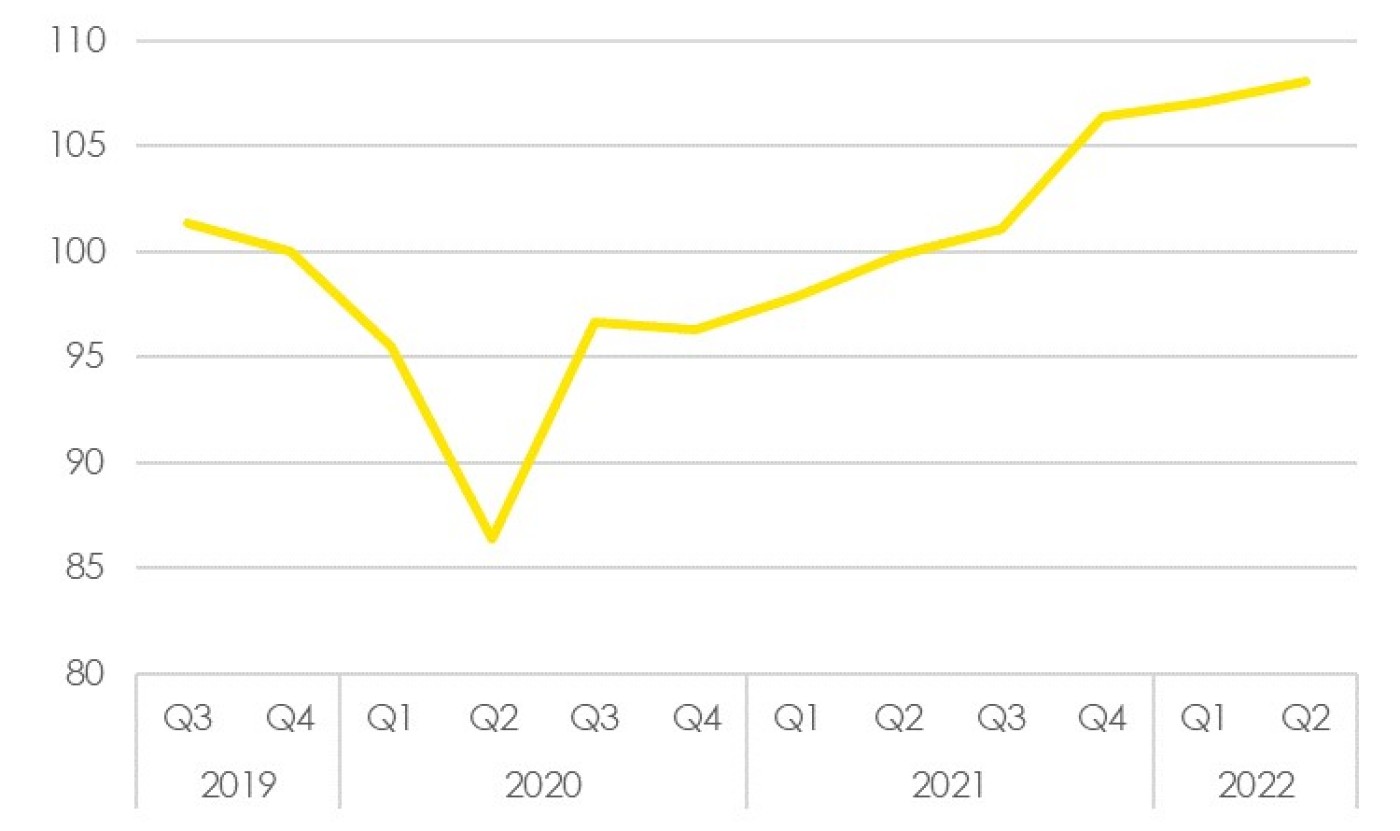

Slovenia, as a small and open export-oriented country, is particularly sensitive to the economic developments of its key trading partners, the core countries of the euro area, especially Germany. The crisis caused by the Covid-19 pandemic naturally has not bypassed Slovenia. Nevertheless, contrary to initial expectations, the country has experienced a smaller decline in GDP than the EU average and a smaller increase in unemployment than most other EU countries. After the 2020 shock, Slovenia’s economic activity has already surpassed its pre-pandemic level in 2021 with a GDP growth of 8.1% yoy. Like in many countries, incomes, business, and eventually overall recovery, were supported by government measures (to around 10% of GDP). Growth was primarily driven by private household consumption, followed by investment. Especially robust growth was reported in the last quarter of 2021, providing a very strong carry-over effect for the growth in 2022.

This was confirmed by the H1 2022 results when the GDP increased by almost 9% in comparison to the same period 2021, driven by household consumption and investments. In Q2 22, the annual growth rate reported a certain slowdown to 8.3% yoy from 9.4% yoy (seasonally adjusted data) but quarterly dynamics accelerated (to 0.9% qoq) due to the rising importance of service and overall robust domestic consumption.

GDP developments (Q419=100)

Source: SURS, RBI/Raiffeisen Research

While in the mid-term, consumption is expected to slow down and return to moderate growth rates, investments will continue with solid and above-average performance in the period between 2022-2025. The double-digit growth rates seen in 2021 are no longer likely, as uncertainty, cost pressure and lower foreign demand will take their toll, but mainly in the private sector. Its restraint from investing will probably be offset by public investments related to the use of EU money (both RRF and funding from the EU budget).

Consequently, strong domestic demand led to an increase in imports, which will exceed the relatively solid export performance. Therefore, a negative (minor) contribution of exports might be expected even this year, before turning again to the positive territory from 2023 onwards.

Slovenia’s direct economic exposure to Russia and Ukraine is very limited (trade with these two countries accounts for 4%), but energy dependency is substantial and therefore represents a key negative risk. Although gas represents around 14% of the total energy consumption, it is a key input for some metallurgy, chemical and paper companies that would struggle to find alternatives, especially since Slovenia has no domestic storage capacity. At first glance, Slovenia imports only 7% of its natural gas and 7% of its oil from Russia, but according to the latest Fitch report, Russian gas (supplied mainly through intermediaries in Austria) accounts for about 80% of total gas consumption, so a sudden halt in gas supplies would hit the economy.

To conclude, despite rising inflationary pressure, uncertainty and still-present supply chain disruptions, 2022 will bring broad-based and still strong growth, driven by domestic demand, mainly consumption and investment, while exports of goods have begun to suffer from lower foreign demand. This could be a prelude to a likely slowdown in 2023. It is inevitable due to the many threats and a possible stagnation or even recession of the industry in the coming winter.

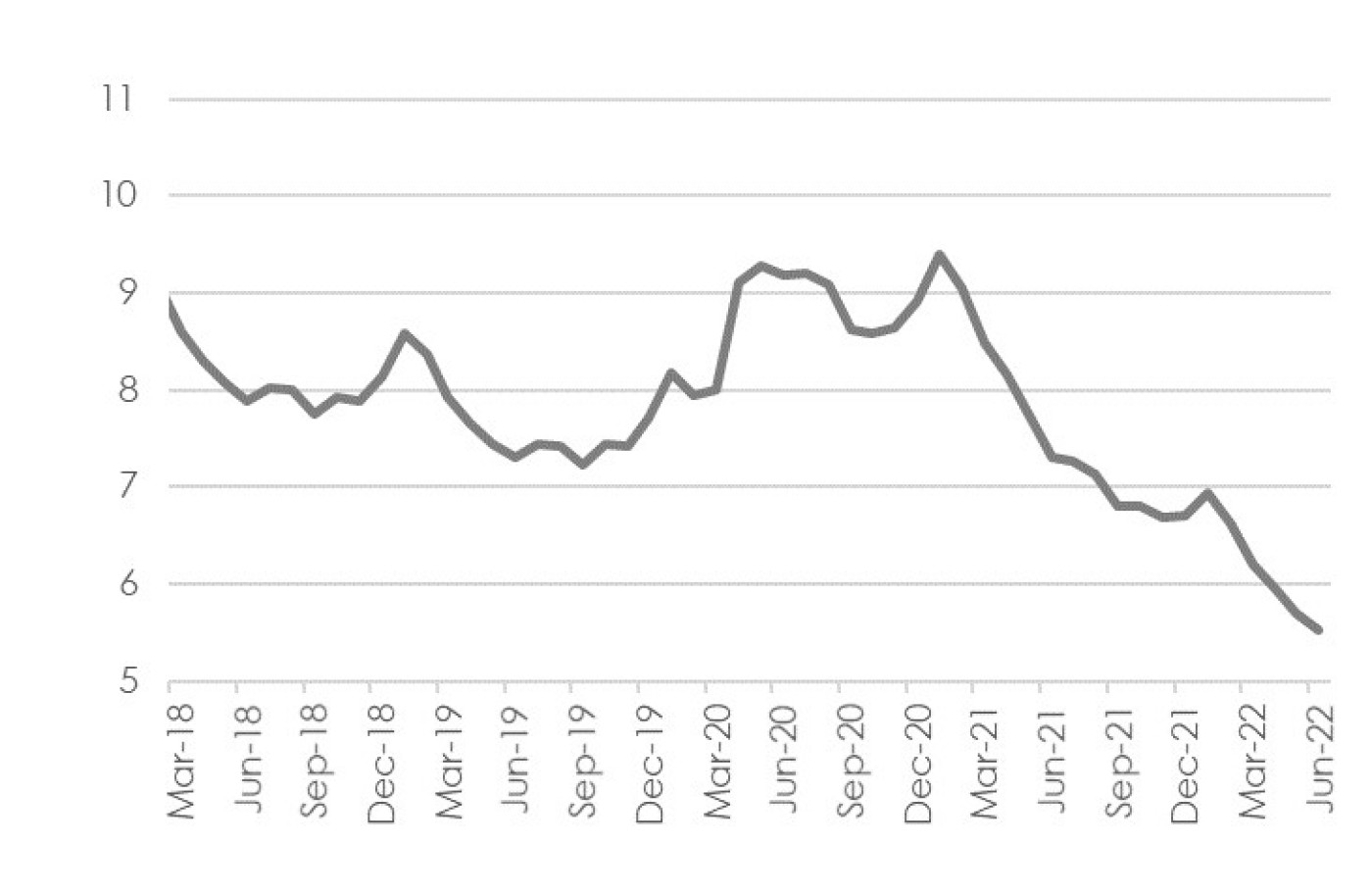

Despite growing inflationary pressures and economic uncertainty that seriously threaten the business and profits of firms, the labour market has remained robust with the lowest unemployment ever (in the first half of 2022 avg. at 6.2%) and additional employment growth. Although a certain moderation of positive development may be expected, the growing labour shortage is putting pressure on wage growth. The growing imbalance between supply and demand in the labour market is attempted to be resolved by inflow of foreign workers, and it is expected that the trend of hiring foreign workers will continue thus stressing also adverse demographic developments.

Unemployment rate (%) has continued to fall

Source: Statistical Office, Republic of Slovenia, RBI/Raiffeisen Research

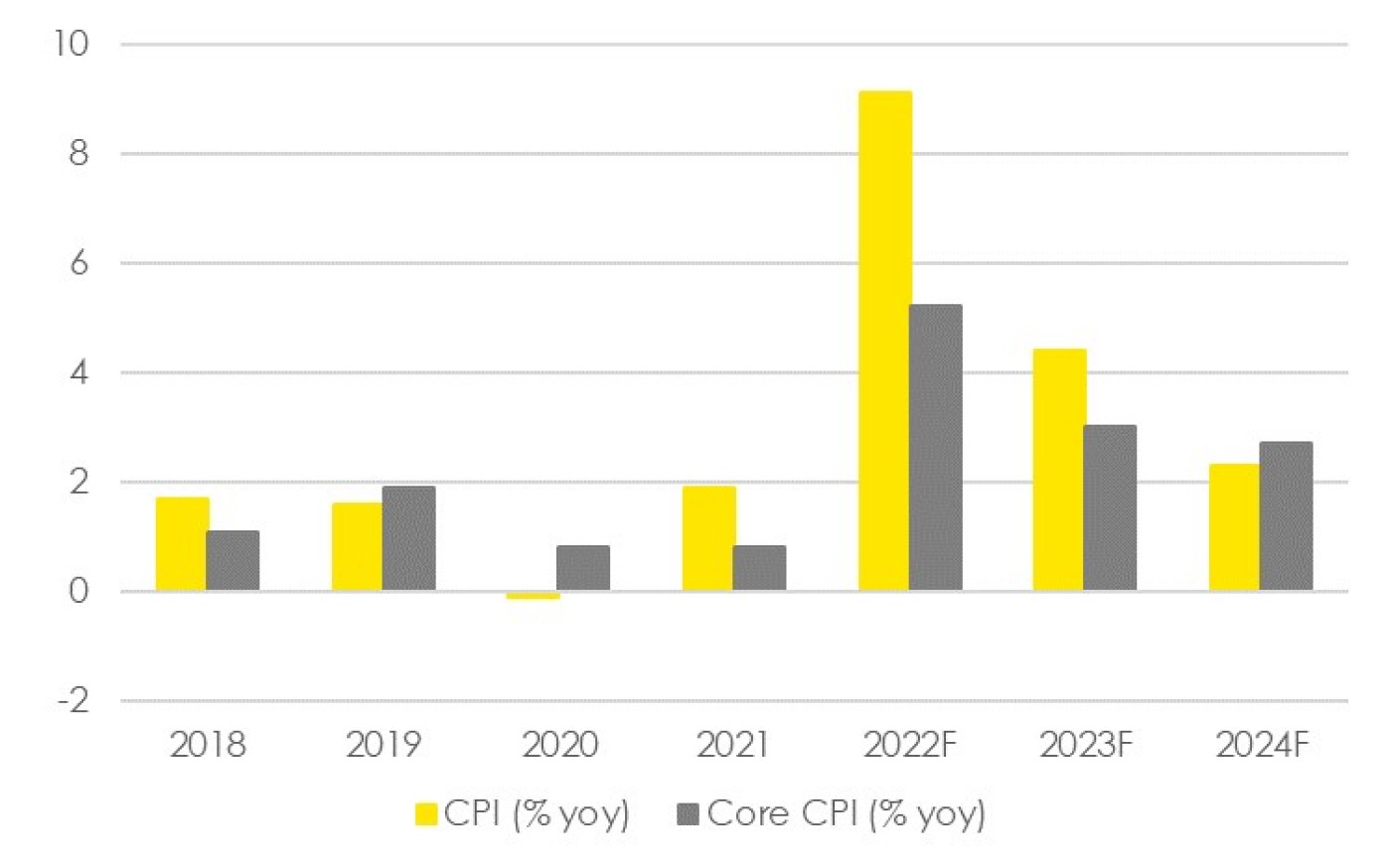

Inflation entered the double-digit territory in June, as most measures to mitigate the impact of high energy prices expired. The elevated figures will not disappear before the second half of 2023 when some stabilisation may be seen. While there is no sign of broader wage pressures driving prices up further, given high inflation expectations and the aforementioned labour shortages, it is increasingly likely that such pressures will emerge.

The rise in prices has led to the adoption of several Government measures to mitigate the impact of inflation. The latest measures could mitigate the price increase of certain energy products (electricity, natural gas, central heating from heating plants and wood biomass) to some extent. Overall, the Government has to juggle between the need for fiscal consolidation and measures to mitigate inflation. For the time being, the decline in the deficit is supported by revenue growth from stronger consumption, while the reduction in the government debt-to-GDP ratio is well supported by strong nominal GDP growth. However, the forecast for 2023 and the slowdown urge caution.

Inflation developments

Source: Banka Slovenije RBI/Raiffeisen Research

Head of Economic Research Department at Raiffeisenbank Austria d.d. Zagreb

Do you also have a travel tip, a recipe recommendation, useful business customs, interesting traditions or a story about CEE that you would like to share? Write to communications@rbinternational.com and share your experience.