The year ahead in CE/SEE: 2022 in reverse?

While many topics from 2022 will remain just as important in 2023, some of the trends observed last year are expected to reverse. In particular, after a peak in Q1, inflation is anticipated to decline which will allow for a discussion on rate cuts later this year as opposed to the dynamic hikes of 2022. On the economic side, 2022 has started strongly, while winter 2023 will weigh on growth rates for the whole year. Governments will continue to intervene to limit the impact of high inflation, but some measures may be reversed throughout the year. All in all, after the negative turn in 2022, there are several positive points in the outlook for the CE/SEE region in the coming months, which we discuss in the following interview with our expert

Dorota Strauch from Raiffeisen Research.

Dorota Strauch

is Head of Research at RBI's Branch Poland and CEE Coverage Lead. She is based in Warsaw.

Follow Dorota on LinkedIn

2022 has been a tough year! After leaving COVID-19 and various lockdowns behind us, the outbreak of the war in Ukraine posed a new challenge. Are we starting the new year 2023 on a more positive footing?

Dorota Strauch: From an economic perspective, this will most likely not yet be the case. Just as the good results of early 2022 boosted the full year results of 2022, the current challenging winter will weigh on the full-year growth in 2023. There are still multiple uncertainties, especially stemming from energy prices (that may return next winter, too). Also, other topics of 2022 will accompany us in 2023: Inflationary pressure and high interest rates will keep weighing on the economy. On a more positive note, following a slowdown in economic growth, we expect a shallow recovery later in the year.

We would also like to stress that, for now, the situation in Europe seems to be unfolding in a more positive manner than expected just a few months ago. This is due to a relatively warm winter (less energy demand) and possible growth impulses from China.

Following a slowdown in economic growth, we expect a shallow recovery later in the year.

What can we expect for CE/SEE? What does the new year have in store for the region?

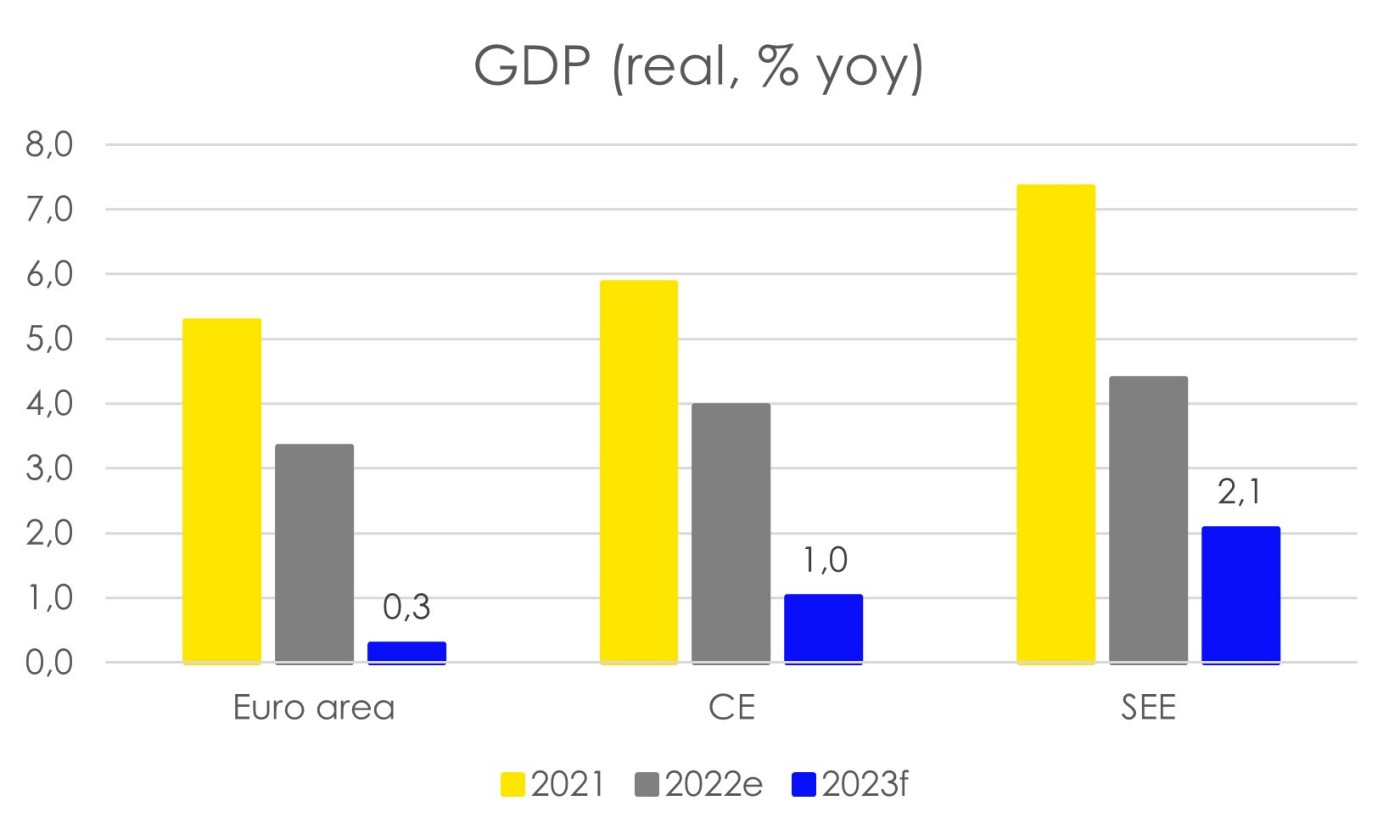

In general, we expect a more pronounced economic slowdown in Central Europe (CE) than in Southeastern Europe (SEE), as the SEE region is less dependent on industry and rather service oriented. While Hungary and Czechia will experience a technical recession in the winter of 2022/23 (two quarters of qoq GDP decline), SEE should be less impacted. CE countries are also more vulnerable to energy supply disruptions, especially Czechia, Slovakia, and Hungary. For SEE, the question is how inflation and weaker consumer demand will affect the next tourism season.

GDP outlook still more positive for SEE than CE and euro area

We expect a more pronounced economic slowdown in Central Europe (CE) than in Southeastern Eruope (SEE).

Finally, politics will certainly play a big role as well. On the one hand, because of the increased role of fiscal policy due to anti-inflationary measures. On the other hand, because of upcoming elections. In Poland a key political event of 2023 will be the Parliamentary elections in autumn that will also affect the dynamics within the EU. A victory of the opposition would ease tensions between Poland and the EU. This would also change the dynamics in EU-wide discussions, where Poland and Hungary have often opposed the EU on some topics. Interestingly, this dynamic has already changed to some extent in 2022, given the development of the war in Ukraine. While Poland was supporting harsher reactions towards Russia, this was not fully supported by the Hungarian government.

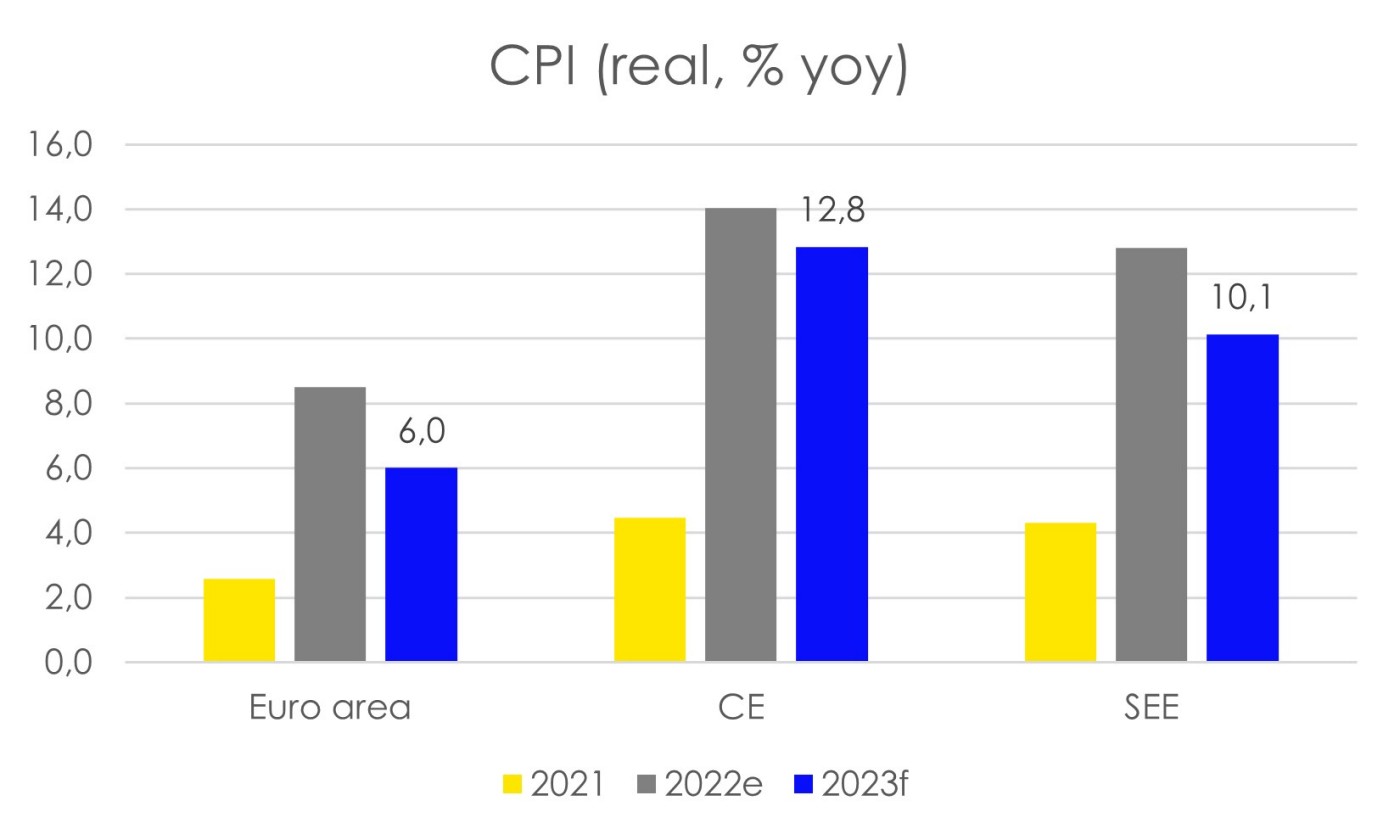

In 2022, inflation continued to rise, reaching levels close to or even above 20% in the CE/SEE countries. What is your outlook for 2023?

2023 is likely to be the year of disinflation, meaning a slowing of the pace of inflation. We expect inflation to peak in the first quarter of 2023 in most countries. However, the path down will not be quick, as we anticipate inflationary levels at the end of the year to still be well above the central banks’ targets. This is largely because the price pressures became much broader during 2023 and no longer only affect food and energy prices, but also other goods (and services). The development of inflation will of course also depend on energy prices and thus on further government interventions. Many of the measures introduced in 2022 will be extended for 2023, but some will be reversed. The clearest example is the recent lifting of the cap on fuel prices in Hungary due to fuel supply problems, which led to an increase in the consumer price index and a revision of our forecast for inflation in 2023 to 18% from 15.7% in the previous year. So, compared to 2022, the government interventions no longer have only a downward impact on inflation. When reversed, they will also lead to price spikes and make it even harder for inflation to return to much lower levels.

Inflation expected to decline but only gradually

2023 is likely to be the year of disinflation.

But it is not only fiscal policy that is trying to fight inflation, is it? Central banks have been on their feet as well.

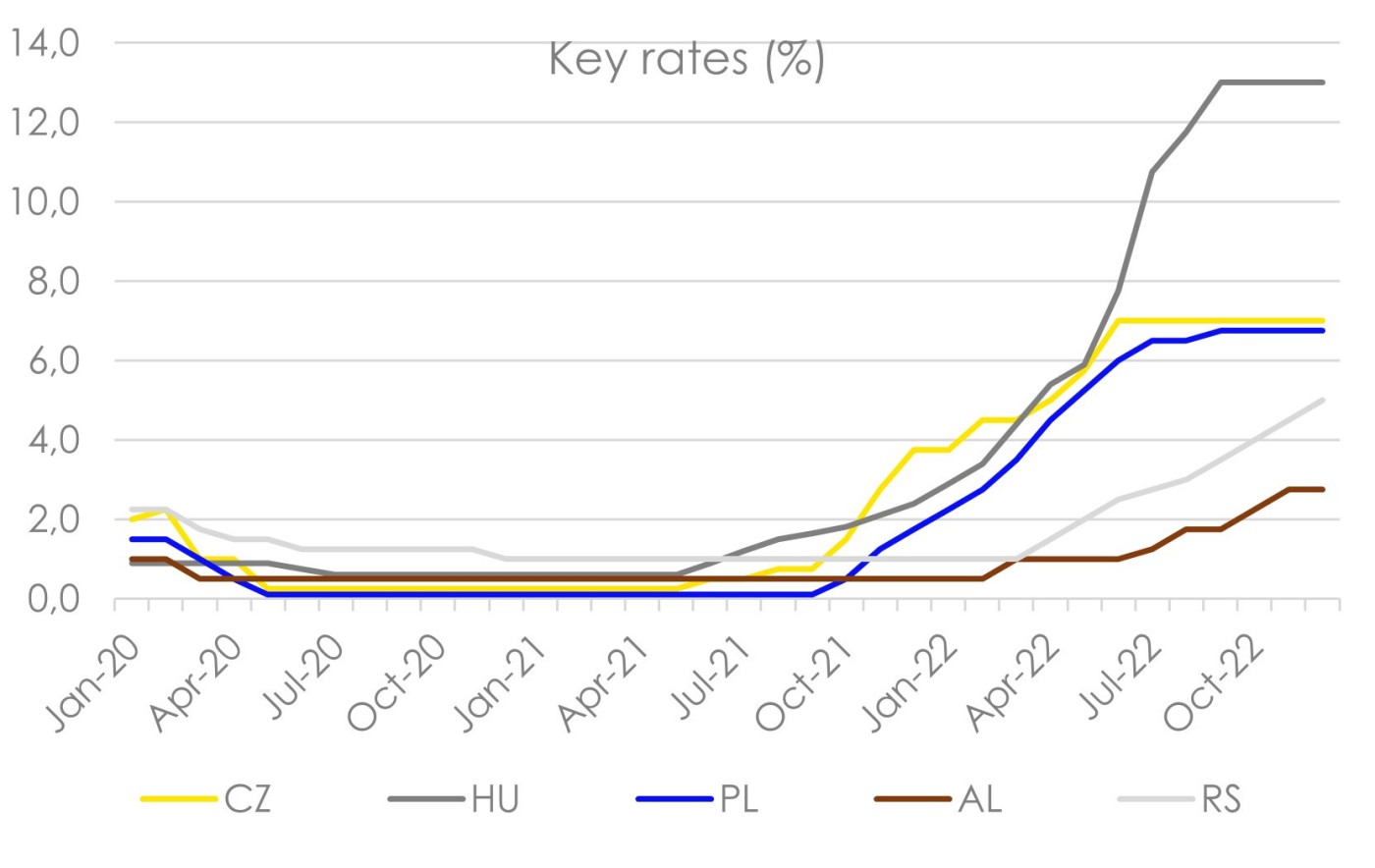

In 2022, all central banks have hiked key interest rates decisively and to historically high levels. In CE the hiking cycles seem to be concluded, which also applies to the Romanian central bank. This now shifts the focus to the timing of the reversal of these hikes, which could take place in the second half of the year at the earliest. However, we expect Czechia and Hungary to be the first countries to start cutting rates (as they are also in a technical recession). However, it should be added that for Hungary this only means a pullback from emergency levels reached in late 2022. Nevertheless, the key interest rate there is expected to be significantly higher than that of the other countries in the region at the end of 2023 (9% vs 6.75% in Poland and 6% forecasted for Czechia).

In SEE (except for Romania), the picture is a little bit different. Gradual monetary tightening is likely to be continued here during 2023, as central banks in Albania or Serbia started to hike key rates relatively late in 2022. This also implies that the target key rates reached in 2023 will be at lower levels than in CE. This occurs also amid lower inflationary pressures in those countries (even though they are still high by historical comparison).

After bold hiking cycles the focus will gradually turn to the timing of rate cuts

So, is there anything more positive to add that we can look forward to in 2023?

The NextGenerationEU (NGEU) funds and the Investment Plan for the Western Balkans will be a supporting factor for the region in 2023. For CEE-EU countries, not only the NGEU funds will be available, but also remaining funds from the previous EU budget (MFF for 2014-2020). For some countries, 2023 should be the peak year for receiving EU funds. Nevertheless, the topic remains hot and, in the case of Hungary and Poland, contributes to market volatility. Relations with the EU remain tense and complex for these two countries, and both have still not received NGEU funds.

Another positive factor is that we expect the impact of the ongoing slowdown/recessions on the labor markets to be rather limited and we do not expect large layoffs but rather a hoarding of employees. This is likely to be the case in CE where there are still labor shortages in some sectors. Companies will be cautious about laying off workers they first had to struggle to find.

All in all, there is room for positive surprises in 2023 as well, despite the ongoing risks and the likely still volatile environment.

Share your CEE experience

Do you also have a travel tip, a recipe recommendation, useful business customs, interesting traditions or a story about CEE that you would like to share? Write to communications@rbinternational.com and share your experience.