Basel Committee publishes second consultation document on the prudential treatment of banks' cryptoasset exposures

The Basel Committee on Banking Supervision (BCBS) recently issued a second public consultation on the prudential treatment of banks' cryptoasset exposures, which builds on the proposals in the first consultation issued in June 2021.

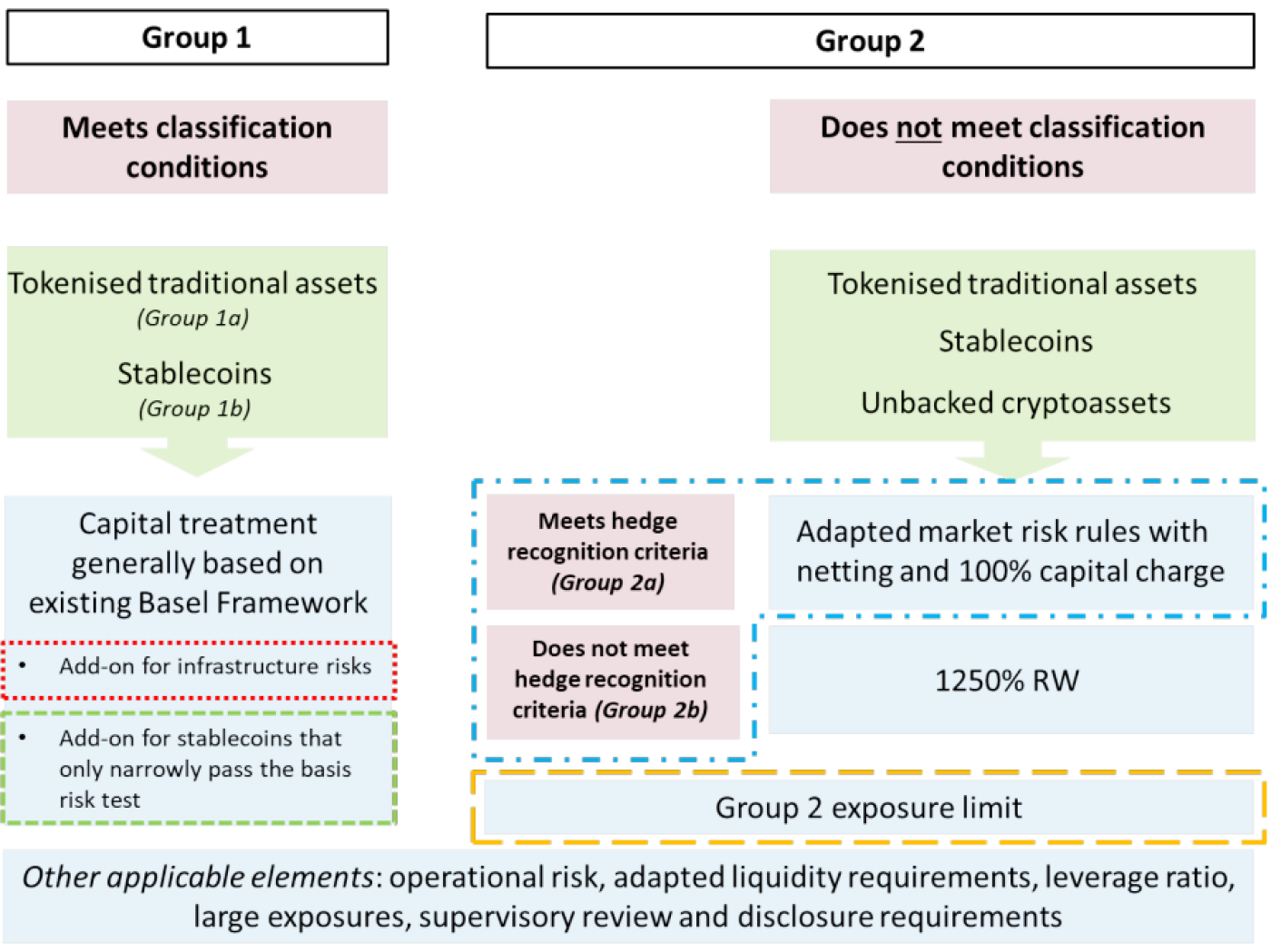

The following diagram illustrates the structure of the proposed risk-based capital requirements set out in the second consultative document, highlighting significant new elements relative to the proposal in the first consultation (new elements are highlighted in dashed/dotted boxes). However, the basic structure of the proposal in the first consultation is maintained, with cryptoassets divided into two broad groups: Group 1 includes those eligible for treatment under the existing Basel Framework with some modifications. Group 2 includes unbacked cryptoasset and stablecoins with ineffective stabilisation mechanisms, which are subject to a new conservative prudential treatment.

The revised proposals give a greater insight into the submitted standard and include new elements such as an:infrastructure risk add-on to cover the new and evolving risks of distributed ledger technologies; adjustments to increase risk sensitivity;and an overall gross limit on Group 2 cryptoassets. The Committee welcomes comments on the proposals, which should be submitted here by 30 September 2022.

Considering the volatile nature and rapid evolution of the cryptoasset market, the Basel Committee will carry on with closely monitoring developments during the consultation period. If shortcomings are identified or new elements of risks emerge the standards the Committee aims to finalise around year-end may be tightened.

For inquiries please contact:

regulatory-advisory@rbinternational.com

RBI Regulatory Advisory

Raiffeisen Bank International AG | Member of RBI Group | Am Stadtpark 9, 1030 Vienna, Austria | Tel: +43 1 71707 - 5923