EU Proposes Adjusting Size Criteria to Simplify Reporting Requirements for Companies

In an exciting move aimed at boosting efficiency and reducing the regulatory burden on companies, the European Commission has just unveiled a Draft Delegated Directive that will amend the thresholds in the Accounting Directive. This proposal seeks to simplify reporting requirements for businesses by recalibrating the size criteria that define micro, small, medium-sized, and large undertakings or groups.

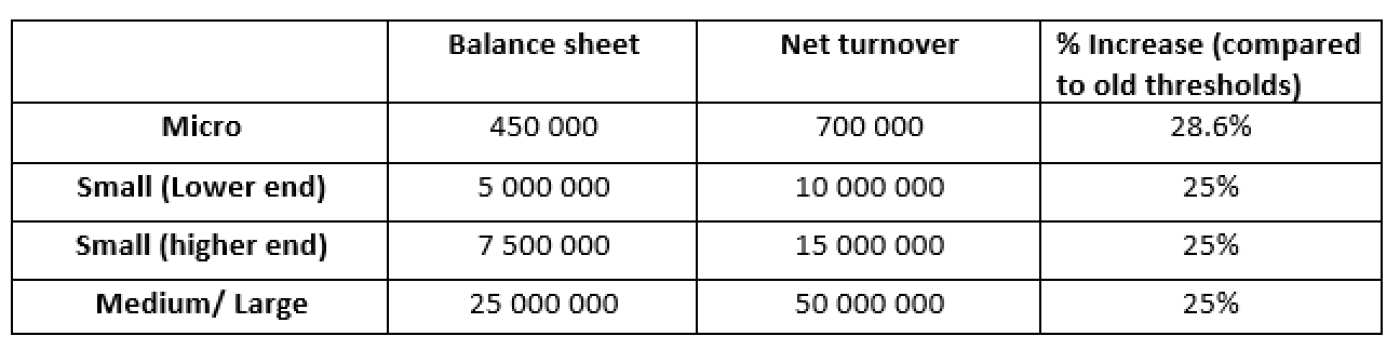

In view of the inflation trend in the euro area in recent years, especially in the last two years, the Commission considers it necessary to amend the size criteria in the Accounting Directive by 25% to adjust for the effects of inflation.

This increase in the size criteria will not only reduce the scope of application of the presentation, audit, and publication requirements for financial statements set out in the Accounting Directive. But it would also reduce the scope of application of the sustainability reporting requirements under the Accounting Directive as amended by the CSRD*, – and, consequently, under Article 8 of the Taxonomy Regulation**– for large undertakings, small and medium-sized undertakings that are listed, and large groups.

The impact of reducing the undertakings in scope of the CSRD consist of one-off cost savings of an estimated EUR 150 million and recurring annual costs of an estimated EUR 700 million.

In the table below the proposed adjusted size criteria:

* Directive (EU) 2022/2464

** Regulation (EU) 2020/852

For inquiries please contact:

regulatory-advisory@rbinternational.com

RBI Regulatory Advisory

Raiffeisen Bank International AG | Member of RBI Group | Am Stadtpark 9, 1030 Vienna, Austria | Tel: +43 1 71707 - 5923