Data recommendations and EU Taxonomy usability from platform on sustainable finance

The platform on sustainable finance, an expert group advising the European Commission (EC) on the development of the EU Taxonomy, delivered a report with 64 Taxonomy usability recommendations.

More than half of them (36 out of 64) were assessed with a high priority, the rest with medium (18) and low priority (10). The recommendations range from improvements in the Taxonomy reporting (Article 8 Delegated Act), to specific topics for credit institutions, to the Corporate Sustainability Reporting Directive (CSRD), etc.

For example, the report includes the recommendation to:

- include all use-of-proceeds financial instruments (loans, bonds, issued by SMEs, large corporates and by sovereigns, supranational and agencies (SSAs)) in all numerators and denominators throughout all legislative texts (Item 8)

- provide a clear and common list of assets to be excluded from the Green Asset Ratio (GAR) and Green Investment Ratio (GIR) (Item 10)

- eliminate the requirement for Financial Market Participants to calculate Taxonomy-alignment of their portfolios using Opex due to high effort but little value added for investors (Item 14)

- create better alignment between the technical guidance on adaptation for enabling activities (item 17)

- allow investors, lenders, and certifying bodies to have direct access to the Energy Performance Certificates and Nearly Zero Energy Buildings databases. (Item 21)

- include SSAs green bonds into both the numerator and denominator of financial undertakings Taxonomy disclosures (item 26)

- a recommendation that (Item 40): -

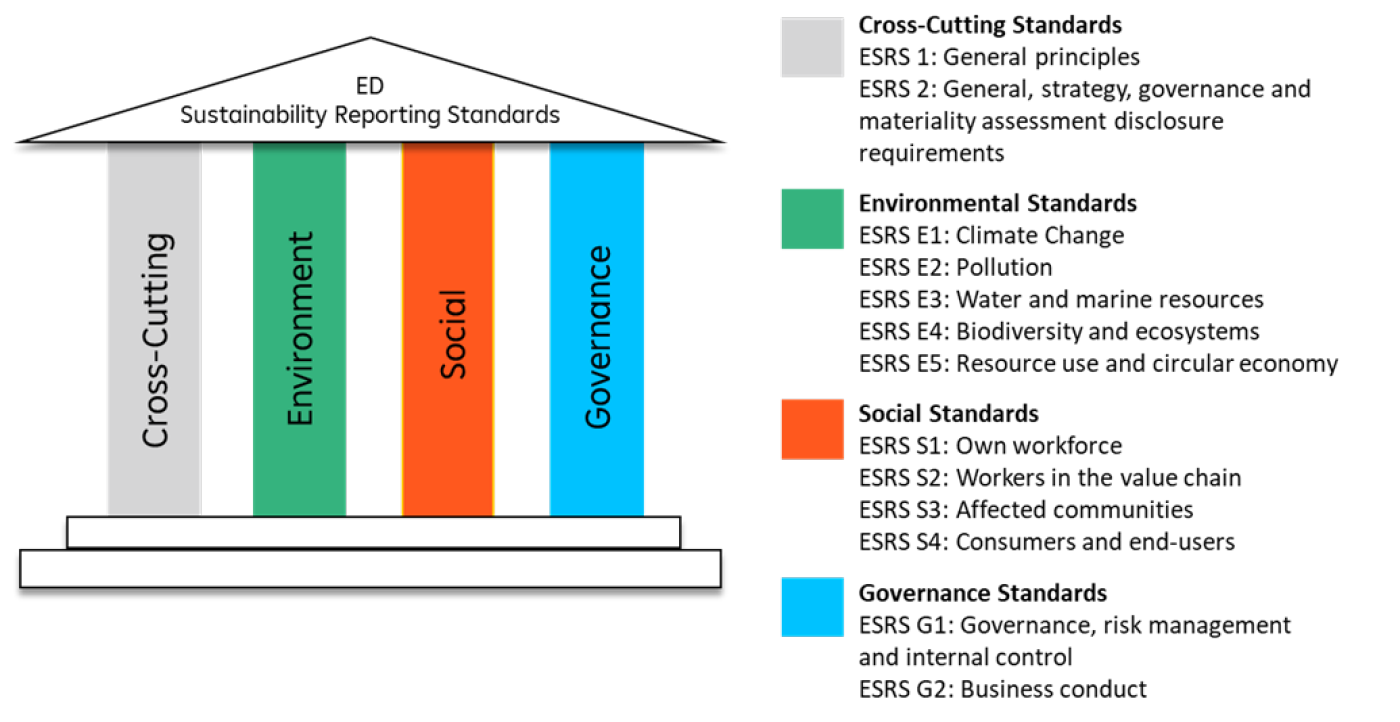

- all terminology used in the CSRD, European sustainability reporting standards, Taxonomy Regulation and Delegated Acts is fully consistent,

- sustainability indicators follow the same underlying methodology for their calculation even if the scope differs

- make a clear distinction between environmental ‘do no significant harm’ in reference to the Taxonomy and ´do no significant harm’ of the SFDR, which is captured through Principle Adverse Impacts (PAI) (Item 42)

- enhance consistency of the PAIs with the Taxonomy by aligning the measurement of PAI indicators to the measurement of DNSH criteria under the Taxonomy (Item 43)

All 64 recommendations are described in the report of the platform on sustainable finance.

For inquiries please contact:

regulatory-advisory@rbinternational.com

RBI Regulatory Advisory

Raiffeisen Bank International AG | Member of RBI Group | Am Stadtpark 9, 1030 Vienna, Austria | Tel: +43 1 71707 - 5923