Scaled-Back Corporate Sustainability Due Diligence Directive (CSDDD) approved by EU Council

EU member states in the European Council have agreed on the Corporate Sustainability Due Diligence Directive (CSDDD). This landmark legislation imposes mandatory obligations on companies to address adverse impacts on human rights and the environment. Despite initial concerns of a potential blocking minority formed by Germany, Italy, France and a few other smaller member states, a compromise has been reached. After several postponements of the final vote, the Council has adopted their final version of the text on 15 March 2024.

Main provisions:

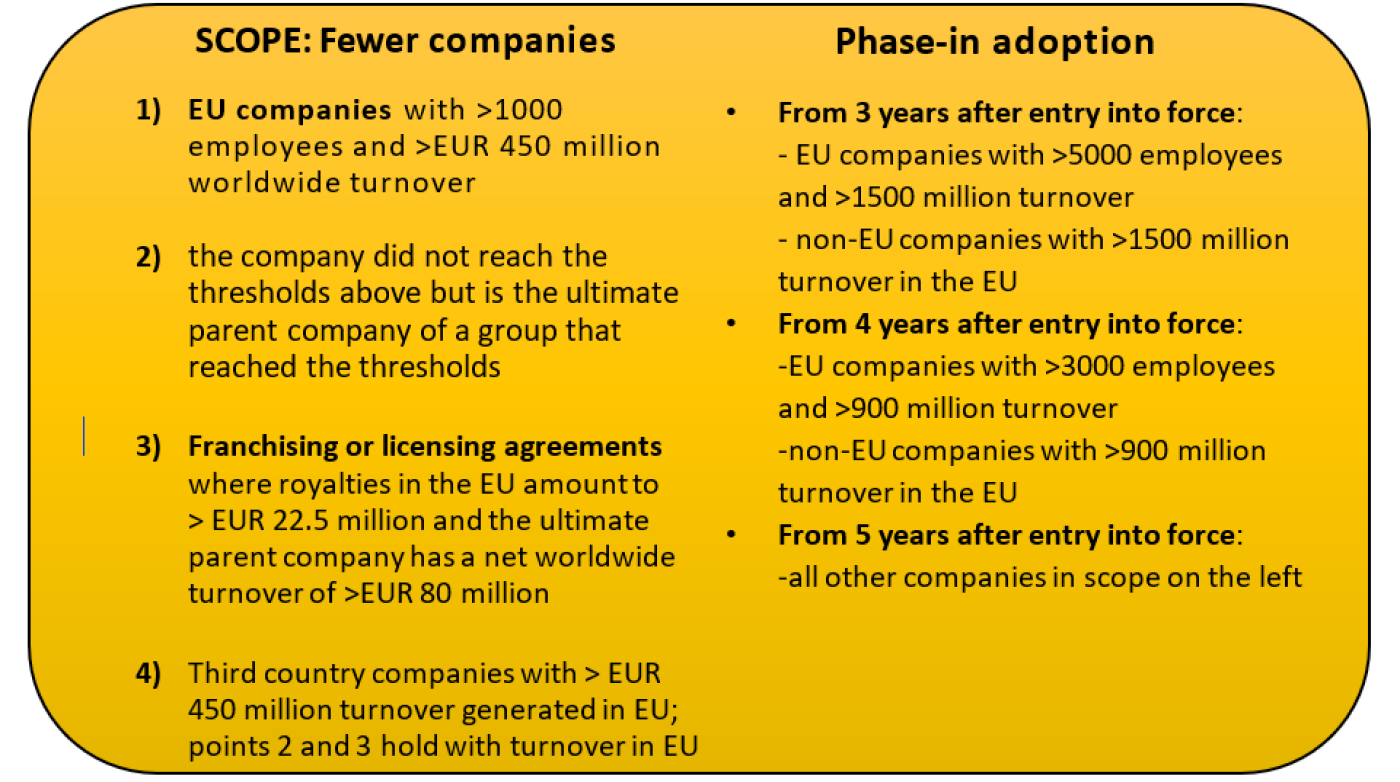

The new thresholds will mean that approximately 5,500 companies will be in scope, which would be almost 70% less than under the political compromise reached in December.The lower thresholds for high-risk sectors have also been removed, with the possibility of reconsideration in the future.

Main components of the Council’s final CSDDD text include:

- The controversial provision on civil liability was amended to give Member States greater flexibility. Most importantly, it will be for the Member States to provide for “reasonable conditions” under which injured parties may authorise NGOs or other organisations to bring actions to enforce their rights.

- The financial sector will initially apply the CSDDD to their own operations and upstream chain of activities. Banks’ financial services are currently excluded from CSDDD obligations and chain of activities definition, however the European Commission may consider expanding the scope for this sector in the future based on impact assessments.

- Reducing activities that will be subject to due diligence duties, cutting out product disposal, dismantling and recycling, and composting and landfill.

- Directors’ duties article has been removed but the transition plan still needs to be implemented on a best effort basis and in line with the 1.5-degree pathway

Next steps

Once formally approved in the voting of the European Parliament and the member states, expected May/June 2024, the directive will enter into force on the twentieth day following its publication in the EU Official Journal.

For inquiries please contact:

regulatory-advisory@rbinternational.com

RBI Regulatory Advisory

Raiffeisen Bank International AG | Member of RBI Group | Am Stadtpark 9, 1030 Vienna, Austria | Tel: +43 1 71707 - 5923