Regulatory concept of Maximum Distributable Amount (MDA) for credit institutions

The Capital Requirements Directives (CRD) introduced the Maximum Distributable Amount (MDA) concept in Art 141. The MDA represents the maximum amount available for variable payments of a bank i.e., dividend payments, AT1 coupon distributions or variable remunerations and comes into force whenever the applicable requirements are not met.

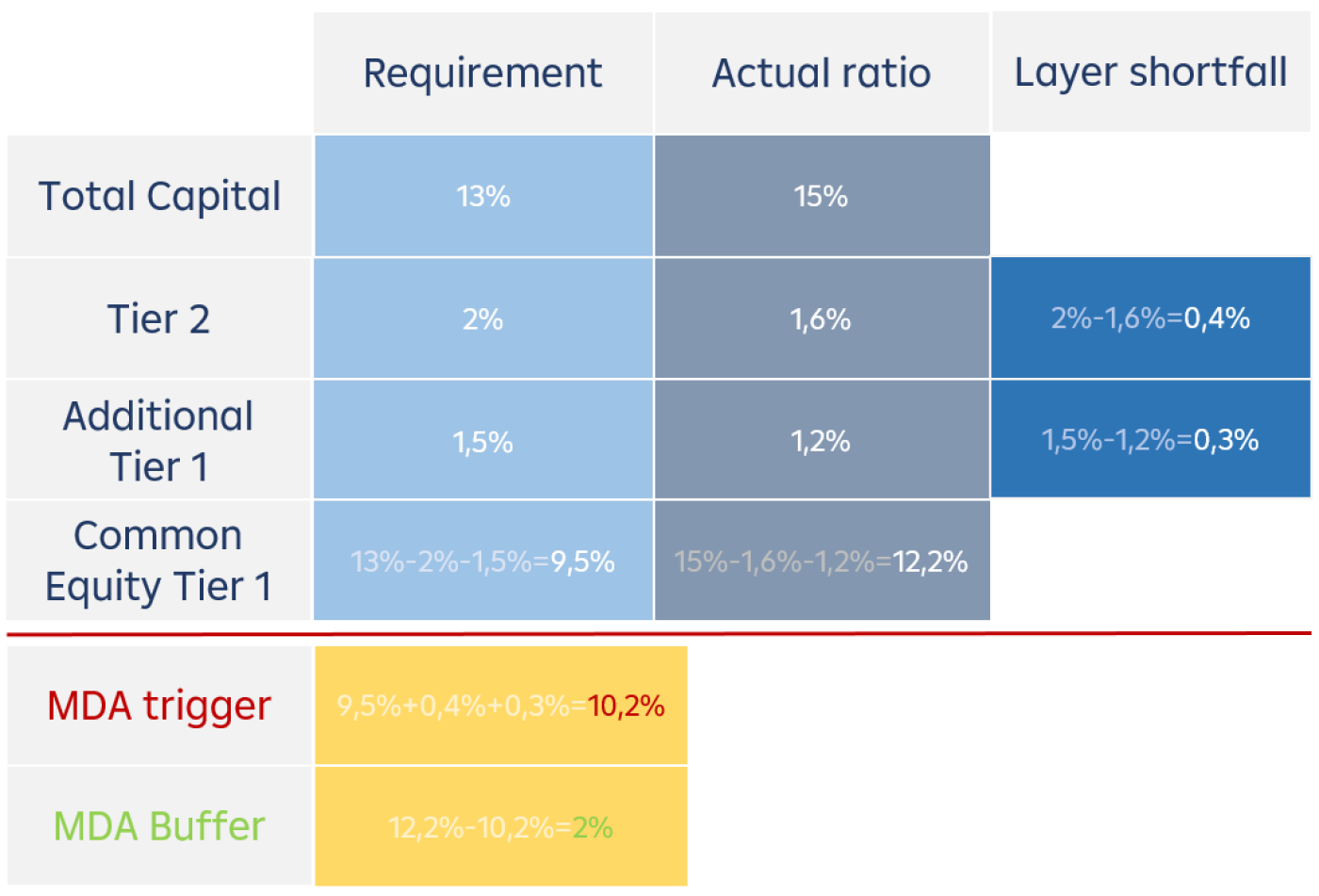

For example, Bank X has an actual total capital ratio of 15.0% and the regulatory requirement stands at 13% for the total capital. Considering the minimum requirements according to CRR of 1.5% for AT1 and 2.0% for T2, the CET1 requirement is 9.5%.

In the 15.0% total capital included are 1.2% AT1 and 1.6% T2 capital covered with issued instruments, this means a CET1 ratio of 12.2% and 0.3% AT1 and 0.4% T2 capital shortfall to be covered with CET1 capital.

Now we can derive the MDA buffer: 12.2%-(9.5%+0.3%+0.4%)= 2.0% based on the MDA trigger of 10.2% (see the example table below).

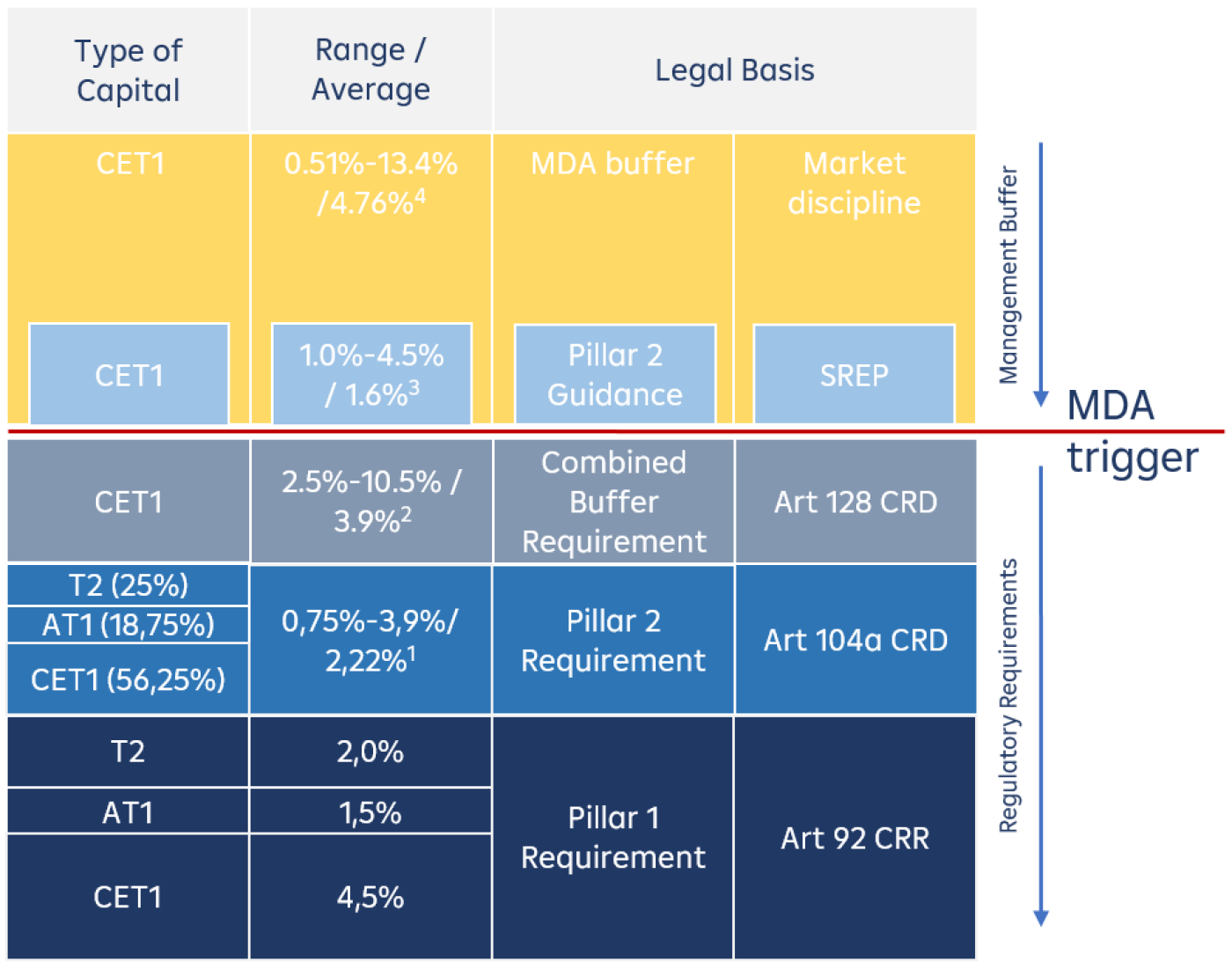

Theoretically, that means that Bank X can pay 2.0% of its CET1 capital in dividends, AT1 coupons, and bonuses before any restrictions start to be applicable. However (see the capital structure overview table below), to be mentioned here, Pillar 2 Guidance (P2G) is a recommendation derived by the competent authority based on stress test results, which has no MDA restriction consequences but also must be considered for variable payment executions.

Therefore, once the capital level is below P2G level, the competent authority must be informed immediately, but distributions such as dividends and bonuses are not subject to automatic restrictions. Competent authorities

will instead consider the reasons and circumstances and may define supervisory measures tailored to each situation and bank individually. For example, if the bank's capital supply does not improve and it cannot restore its P2G, or if it continues to decline, resulting in a breach of the combined buffer requirement, automatic restrictions will be effective on its distributable amount. In this case, Bank X cannot completely use its 2.0% capital surplus for distributions as it would risk supervisory investigations.

You might ask what happens when the MDA buffer is negative / the level of actual capital is below the MDA trigger. The MDA trigger is calculated considering both Pillar 1 and Pillar 2 requirements as well as the combined buffer requirement (see the graph). This means once there is no more capital above the MDA trigger, capital distribution is restricted (based on a bucketing approach which will be explained in a separate knowledge hub article); at this point, for example, the company can only pay on a limited basis dividends to its shareholders. In addition, this triggers the delivery of a capital conservation plan according to Art 141 CRD.

- Range based on min. and max. of 115 banks, source: Pillar 2 requirement ECB

- Range based on min and max of banks from ESRB Members states, source: buffer requirements

- Range based on the minimum requirement possible and the maximum requirement in 2021, source: Pillar 2 Guidance

- Range based on min. and max. of 65 banks within Europe, data taken from year 2021 and 2022 - source: RBI Regulatory Advisory.

For inquiries please contact:

regulatory-advisory@rbinternational.com

RBI Regulatory Advisory

Raiffeisen Bank International AG | Member of RBI Group | Am Stadtpark 9, 1030 Vienna, Austria | Tel: +43 1 71707 - 5923