New instrument class: senior preferred (SP) versus senior non-preferred (SNP) and the effects

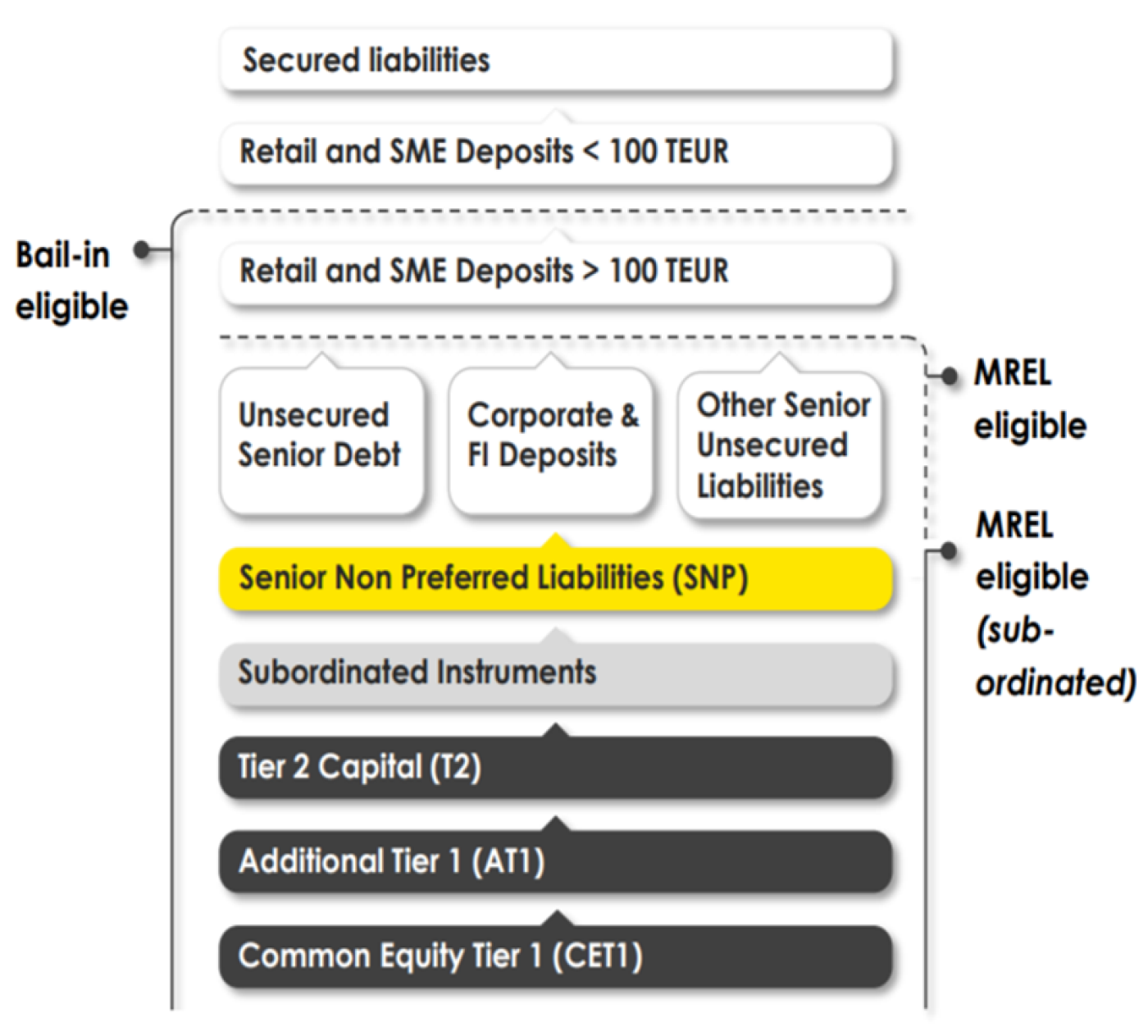

Since end 2017, all member states started to implement / implemented a new class of SNP liabilities in their national insolvency ranking. Liabilities ranking in this new insolvency class are worse off in the event of insolvency and bail-in as compared to SP liabilities but are still no capital instruments like Additional Tier 1 or Tier 2 instruments.

The new class was inserted between these existing two categories, i.e. SP and ordinary capital instruments. In Austria the Federal Act on the Recovery and Resolution of Banks (BaSAG) was amended in June 2018 to include § 131 BaSAG to implement Art 108 of the European Union Bank Recovery and Resolution Directive (BRRD), reflecting this new hierarchy logic.

Why a new insolvency class? Firstly, overall legal certainty gets improved, as the new class puts a clear signal that subordinated instruments bear losses and reduce the risk that the No-Creditor-Worse-Off (NCWO) principle is breached. Secondly, it provides for better transparency to investors, creditors and deposits, which liabilities are eligible for a possible bail-in and thus allows better pricing, market discipline and risk diversification.

In general, SNP instruments also bear losses before any haircuts are applied to the senior instruments layer in case of a resolution. So, as a result, the risk for investors is elevated and such instruments offer a different risk profile.

Example for Austria § 131 BaSAG, Source: RBI.

In principle any bank can choose whether to issue SP or SNP instrument type, that is which type of senior bond the bank wants to offer to its investors.

However, it is important to note that the resolution authority can determine a subordination requirement which needs to be fulfilled with capital instruments or SNP liabilities. For most banks, the subordination requirement is based on a case-by-case decision. The largest banks, global systemically important banks and banks with a balance sheet > EUR 100bn, need to maintain a minimum Pillar-1 subordination requirement of 18% of Total Risk Exposure Amount / 6.75% of Leverage Ratio Exposure and 13.5% of Total Risk Exposure Amount / 5% of Leverage Ratio Exposure respectively.

Despite the current uncertain market environment, banks under the SRB’s remit managed to issue MREL-eligible instruments during the second quarter of 2022 amounting to EUR 67.3 bn (further details see SRB MREL Dashboard banks Q2 2022). SP liabilities accounted for 41% of total issuances and SNP liabilities respectively for 31%. As regards the cost of funding, at the end of October the spreads for senior debt stood at 121bps and for subordinated debt at 214bps as measured by respective iTraxx indexes – so SNP are typically more expensive for a bank than senior debt.

For inquiries please contact:

regulatory-advisory@rbinternational.com

RBI Regulatory Advisory

Raiffeisen Bank International AG | Member of RBI Group | Am Stadtpark 9, 1030 Vienna, Austria | Tel: +43 1 71707 - 5923