Understanding Banking Resolution and its Implementation in Europe

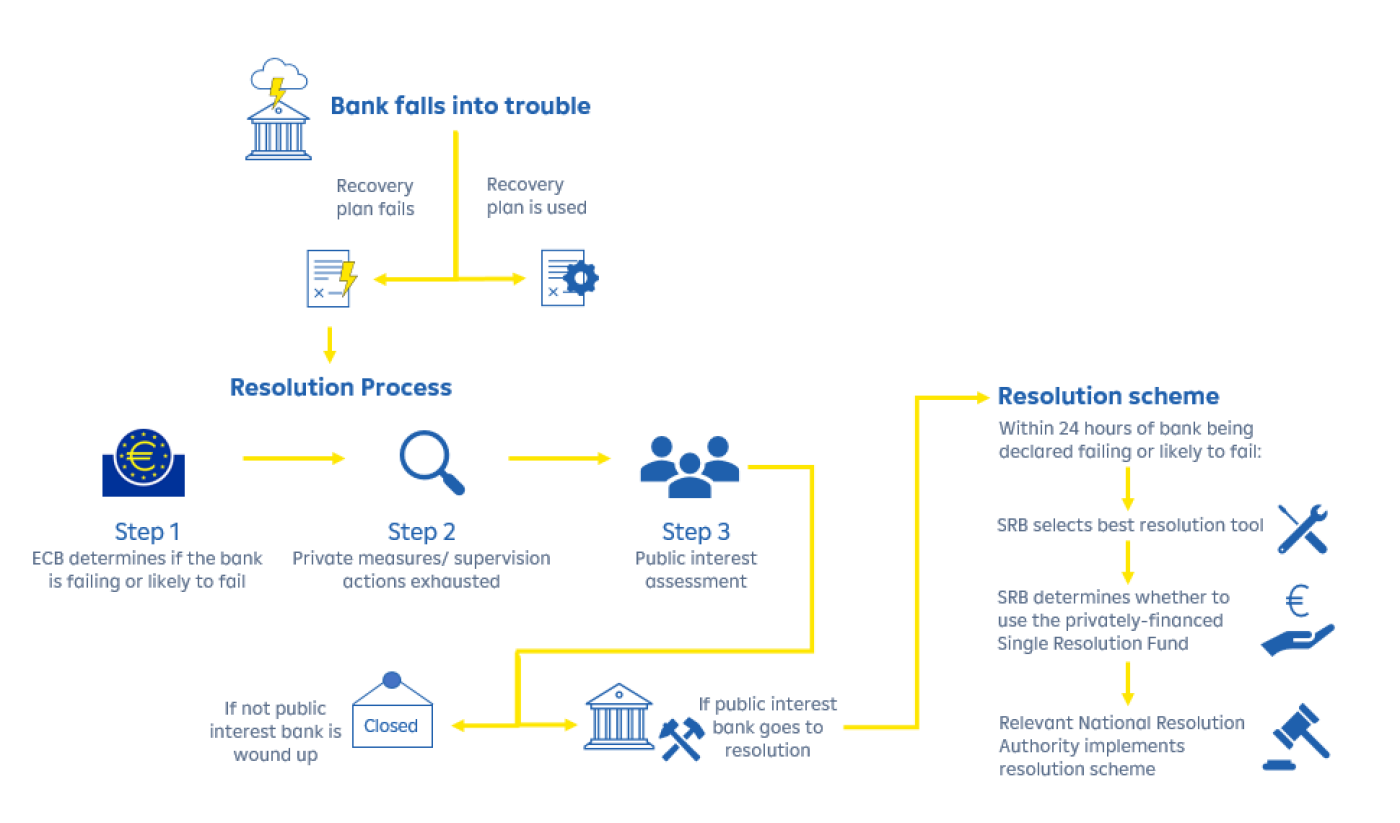

Resolution is a process that refers to the tools and procedures used by regulators and authorities to manage the failure of a financial institution in a way that minimizes the risk to financial stability and protects taxpayers. The resolution process is an important component of financial regulation and is designed to ensure that failing financial institutions can be resolved in a way that does not threaten the broader economy.

The background of bank resolution in Europe is closely tied to the 2008 financial crisis, which highlighted the need for a more effective and coordinated approach to resolving failing banks. Prior to the crisis, each EU member state had its own approach to resolving failing banks, which often involved costly taxpayer-funded bailouts.

In this article, we will cover the following topics:

- Key participants of the resolution framework,

- The Banking Union's three pillars,

- Resolution Tools,

- Resolution strategy options,

- and Resolution Mechanism Step by step.

Key Participants:

In Europe, the resolution process involves several key participants, including the European Central Bank (ECB), the Single Resolution Board (SRB), and competent national authorities. The ECB is responsible for supervising significant banks, while the SRB is responsible for developing resolution plans and making resolution decisions for banks under their remit within the Banking Union. Banks which are not covered by the SRB are supervised by national competent authorities.

The Single Resolution Board (SRB) is the central resolution authority within the Banking Union, together with the National Resolution Authorities (NRAs), it forms the Single Resolution Mechanism (SRM).

As of 1 July 2022, there are 115 banks under SRB's remit. This number is bound to change over time as new banks are established, and existing banks leave the market.

The key participants mentioned above are part of the different EU Banking Union pillars.

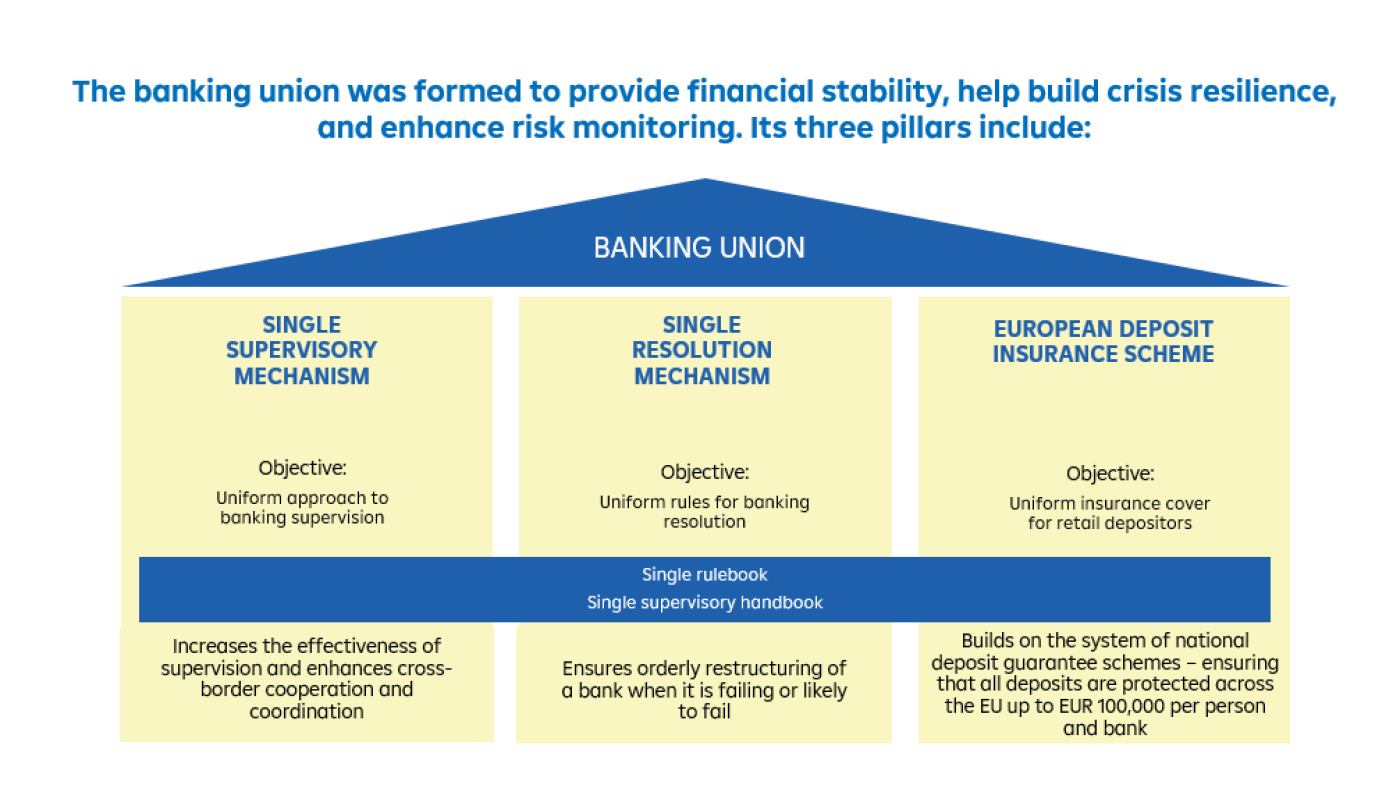

The Banking Union's three pillars:

Single Supervisory Mechanism (SSM): The SSM is responsible for ensuring that banks in the Eurozone are operating safely and soundly. It was established in 2014 and is composed of the European Central Bank (ECB) and the national supervisory authorities of participating countries. The ECB is responsible for supervising the significant banks in the Eurozone, while the national supervisory authorities are responsible for supervising the less significant institutions.

Single Resolution Mechanism (SRM): The SRM is responsible for resolving failing banks in the Eurozone in an orderly manner. It was also established in 2014 and is composed of the SRB and the national resolution authorities of participating countries. The SRB is responsible for developing resolution plans and making resolution decisions for banks within the Banking Union. The SRM aims to minimize the impact of bank failures on the economy and protect taxpayers. European Deposit Insurance Scheme (EDIS): The EDIS is a proposed scheme that aims to provide a common deposit insurance scheme for all banks in the Eurozone. It is designed to protect depositors in the event of a bank failure and to contribute to financial stability. The EDIS would be funded by contributions from the banks themselves rather than by taxpayers. It is currently in the process of being developed and is not yet operational.

The idea of the EU Banking Union is to ensure a level playing field across the EU with the single supervisory mechanism, to ensure the safety of deposits in every country and for the worst case prepare banks for their resolution. The next paragraph gives an overview of the four resolution tools.

Resolution Tools:

The resolution process in Europe includes several resolution tools, including bail-in, bridge institution, sale of the business, and asset separation. Bail-in involves the conversion of a failing bank's liabilities into equity, while the sale of a business involves the sale of a failing bank's assets and liabilities to a healthy institution. A bridge institution is a temporary entity that is established to manage a failing bank's assets and liabilities until they can be sold or wound down. Asset separation involves the transfer of a failing bank's bad assets to a separate entity, allowing the healthy part of the bank to continue operating.

Here are some examples of how these resolution tools have been used in Europe:

Bail-in: In 2013, Cyprus faced a banking crisis that threatened to destabilize the country's economy. The local government and the EU agreed on a bailout plan that included a bail-in of depositors, where deposits over 100,000 euros were converted into equity of the affected banks. This measure was controversial but was seen as necessary to avoid a complete collapse of the Cypriot banking system.

Bridge Institution: In 2015, the Portuguese government created Novo Banco as a bridge institution to take over the healthy assets and liabilities of Banco Espirito Santo, which had failed. Novo Banco was intended to be a temporary entity that would manage the assets and liabilities until they could be sold or wound down.

Sale of Business: In 2017, the Italian government facilitated the sale of two failing banks, Banca Popolare di Vicenza and Veneto Banca, to Intesa Sanpaolo, a healthier Italian bank. This allowed the government to avoid a costly bailout and prevented a disorderly resolution of the banks.

Asset Separation: In 2012, Spain established Sareb, also known as the "bad bank," as a separate entity to manage the bad assets of four nationalized banks. The goal was to allow the healthy parts of the banks to continue operating while the bad assets were managed and eventually sold. Sareb

still exists today and is responsible for managing and selling the remaining

assets.

In 2014, Austria created a "bad bank", HETA Asset Resolution AG, to manage the bad assets of Hypo Alpe Adria, a failed bank that was nationalized during the financial crisis. HETA was responsible for winding down the bad assets and maximizing their value through sales and other means. Similarly, Volksbanken-AG had its own "bad bank", Immigon, which was established in 2010 and managed the bad assets of the bank. Both HETA and Immigon were intended to allow the healthy parts of the banks to continue operating while the bad assets were dealt with separately.

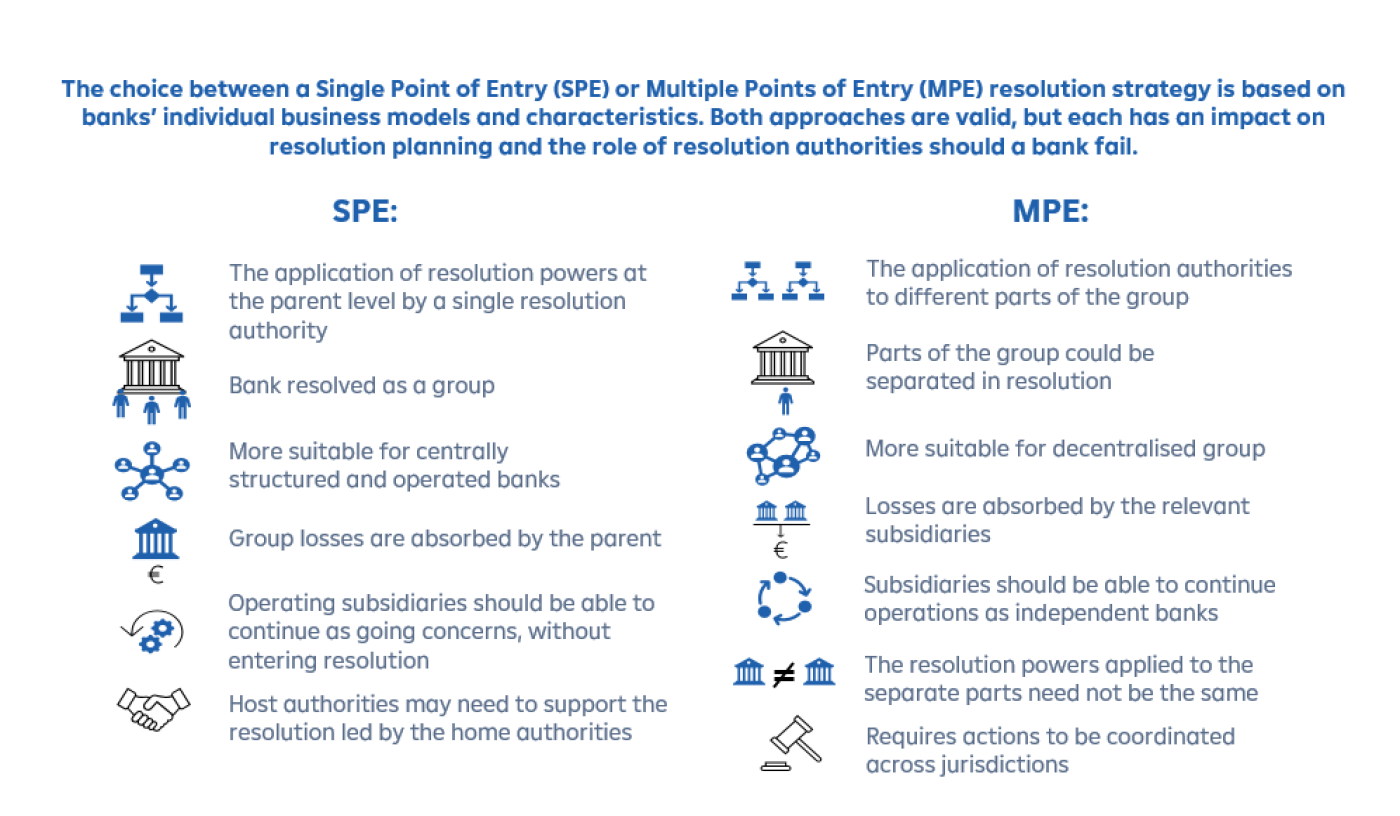

Besides the actual resolution tools, there are two resolution strategies which needed to be decided before applying them to any banking group. The two options are chosen by each bank individually and are aligned with their business model. In the paragraph below you find a short summary and a graphical illustration highlighting their main differences.

Resolution strategies options:

Single Point of Entry (SPE) Resolution Strategy: The SPE resolution strategy involves resolving a failing bank at the top holding company level rather than at the subsidiary level. Under this approach, the losses of the failing bank are absorbed by the holding company rather than by the subsidiary banks. After the loss absorption e.g. through bail in, the healthy subsidiaries of the bank remain open and continue to operate under the new holding company. The SPE approach is favored by the SRM in Europe because it is seen as more efficient and less disruptive than the MPE approach.

Multiple Points of Entry (MPE) Resolution Strategy: The MPE resolution strategy involves resolving a failing bank at the a specific resolution group level rather than at the holding company level. Under this approach, each separate resolution group of the banking group is resolved individually.

This approach is more complex and time-consuming than the SPE approach, as it requires coordination and cooperation between multiple national resolution authorities.

Resolution Mechanism Step by step:

The resolution mechanism in Europe involves several steps. The first step is the preparation of a resolution plan, which outlines the resolution strategy for a particular institution. The SRB is overseeing development of these plans. The second step is the decision to enter into resolution, which is made by the SRB in consultation with the ECB and national resolution authorities. The third step is the implementation of the resolution plan, which involves the use of resolution tools to manage the failing institution. The final step is the post-resolution phase, which involves the transfer of assets and liabilities to a healthy institution, the recapitalization after a bail-in, the winding down of the failed institution, or the establishment of a bridge institution.

For inquiries please contact:

regulatory-advisory@rbinternational.com

RBI Regulatory Advisory

Raiffeisen Bank International AG | Member of RBI Group | Am Stadtpark 9, 1030 Vienna, Austria | Tel: +43 1 71707 - 5923