Leverage ratio

Leverage ratios are used to assess how exposed institutions are to excessive leverage risks. CRR requires institutions to report all necessary information to their supervisors about leverage ratios and their components.

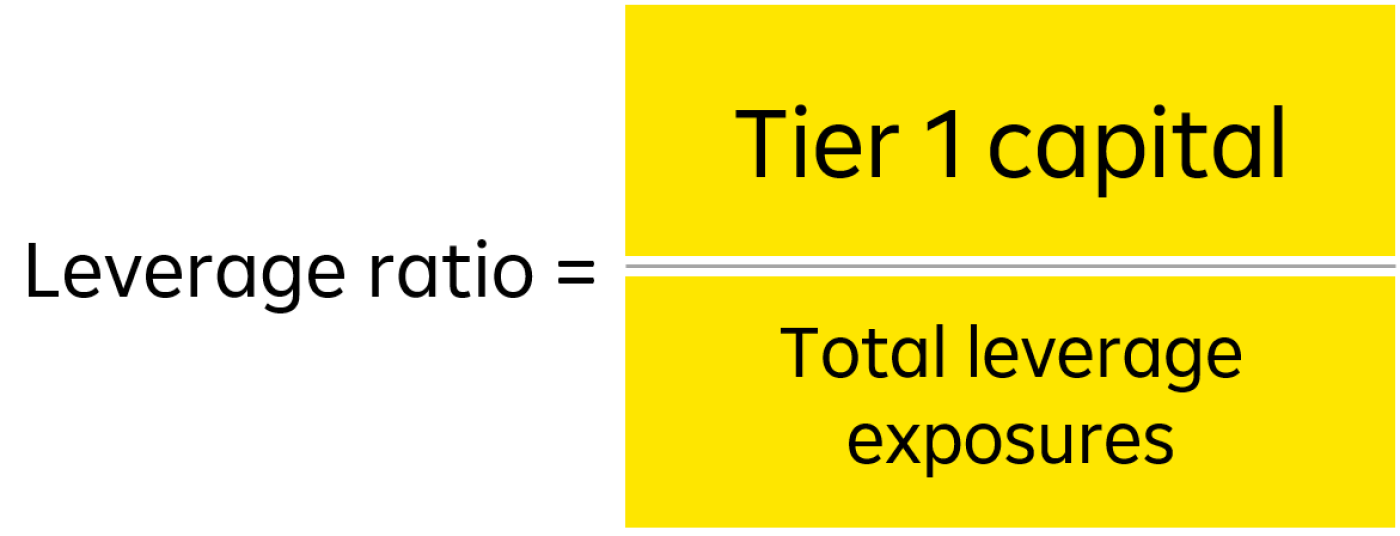

As well as this, institutions must disclose information to the market regarding their leverage ratio. A uniform format and modalities for reporting and disclosure are provided by the EBA when necessary. The EBA also scrutinizes the implementation of CRR provisions by institutions and competent authorities. This monitoring will be covered in a dedicated report, with guidance provided by the EBA when appropriate. The genral formula is as follows:

The leverage ratio requirement is 3% of Tier 1 capital, and it is added to the own funds requirements in Article 92 of the CRR and must be calculated in accordance with Article 429. Since a 3% leverage ratio would constrain certain business models and lines of business more than others, further adjustments are warranted.

Institutions may reduce the leverage ratio exposure measure for public lending by public development banks (Article 429a(1)(d)), pass-through loans (Article 429(1)(e)) and officially guaranteed export credits (Article 429a(1)(f)).

For inquiries please contact:

regulatory-advisory@rbinternational.com

RBI Regulatory Advisory

Raiffeisen Bank International AG | Member of RBI Group | Am Stadtpark 9, 1030 Vienna, Austria | Tel: +43 1 71707 - 5923