The voluntary carbon market

The voluntary carbon market (VCM) can be a vital tool in achieving net zero emission goals. Through the VCM, financial resources flow into carbon offset projects, providing corporations with carbon credits to fulfil their emission goals. However, the market experiences some greenwashing controversy, especially concerning estimating carbon credits for specific offset projects.

How does it work?

Contrary to its governmental counterparts, such as the EU Emissions Trading System (EU ETS), which requires certain industry sectors in the EU to buy emission allowances for their CO2 emissions, the VCM is voluntary.

The general idea is that corporations buy carbon credits via specialised brokers to reach their net zero emission goals for a specific year. One credit equals one ton of CO2 emissions. Simply put, corporates buy carbon credits to balance their emitted tonnes of CO2. Emissions and credits are netted, potentially resulting in net zero emissions for the company.

What are these projects and how are carbon credits calculated?

Private organisations set up carbon avoidance/ removal projects, which are evaluated by certifiers of carbon credits. These certifiers developed methodologies for estimating the amount of carbon credits for different types of projects. However, currently, there is no governmental oversight or regulation.

The avoidance projects stretch from preventing deforestation, avoiding damage to ecosystems in general, etc. For example, one method for estimating carbon credits of deforestation projects is to look at potentially released emissions if the project would not have been established.

Carbon removal projects capture carbon directly from the air either by planting new trees or by direct air capture with carbon storage by specialised facilities.

Problems of the voluntary carbon market

Criticism of the VCM currently focuses on the independent certifiers of carbon credits and their methods of estimating the amount of carbon credits. The argument is that certain projects avoid significantly less carbon than estimated by the certifiers1. This means that too many carbon credits might have been certified.

The voluntary carbon market contributes to the emission reduction goals, either by avoiding carbon emissions in the first place or by removing and storing them. If the sector can get rid of the current controversy concerning carbon credit estimates, it will continue to play its role in corporate emission setting strategies and support the global climate goals.

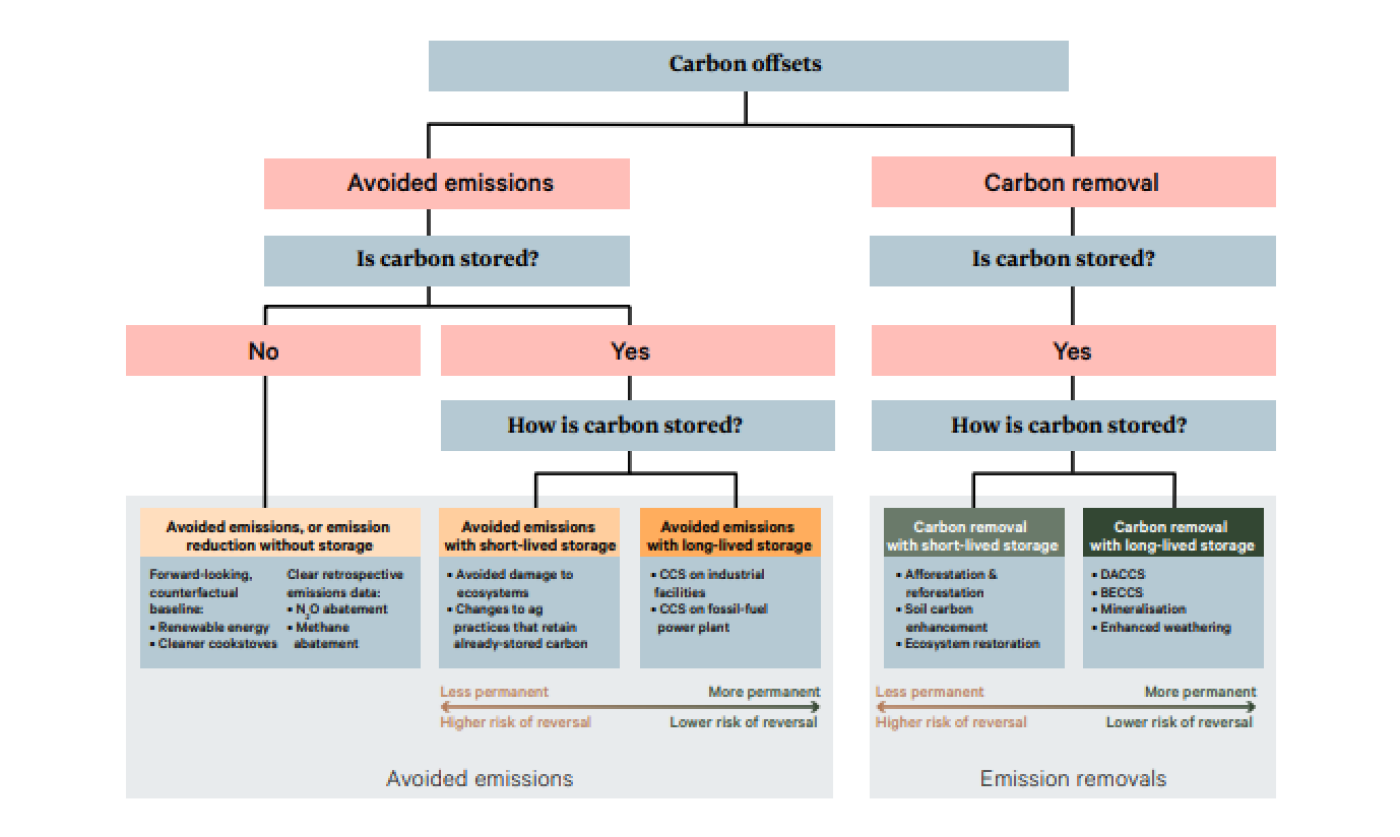

Illustration on classification of carbon offsets:

Source: Partnership for Carbon Accounting Financials – Financed Emissions 2nd Edition (2022) page 32

For inquiries please contact:

regulatory-advisory@rbinternational.com

RBI Regulatory Advisory

Raiffeisen Bank International AG | Member of RBI Group | Am Stadtpark 9, 1030 Vienna, Austria | Tel: +43 1 71707 - 5923