EU Emission Trading System

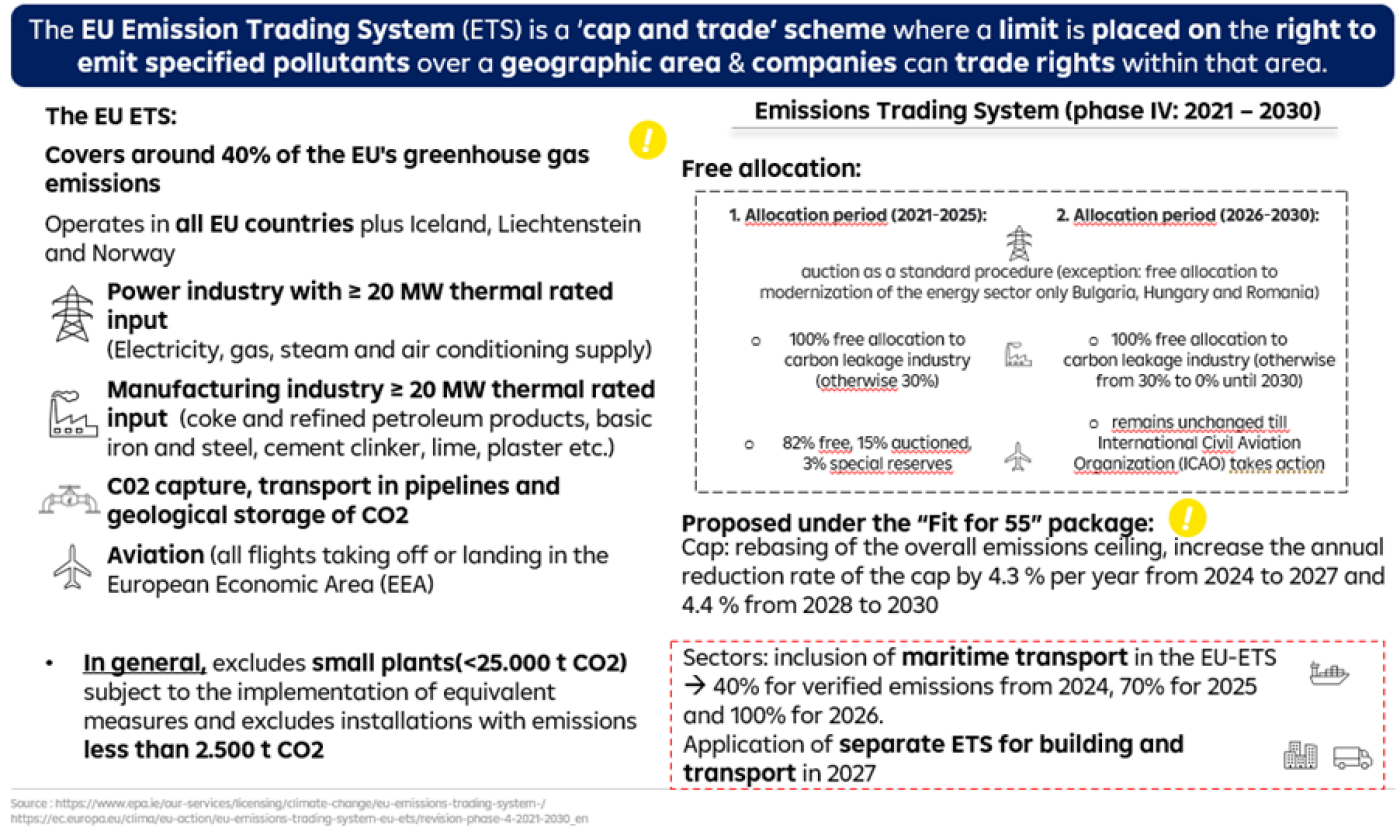

The Emission Trading System (ETS) in the European Union (EU) is a market-based mechanism designed to reduce greenhouse gas emissions from certain industrial sectors in a cost-effective manner. It is the world's first and largest international carbon market, covering more than 11,000 power plants and manufacturing installations across 31 countries, including all EU member states as well as Iceland, Liechtenstein, and Norway.

The cap-and-trade principle is the foundation of the EU ETS, wherein a cap or limit is set on the total amount of greenhouse gas emissions that can be released by covered installations. This cap is gradually reduced over time to achieve emissions reduction targets. Within this cap, installations are allocated or auctioned a certain number of allowances, which represent the right to emit one tonne of CO2 or its equivalent. These allowances can be traded among participants in the market.

The EU ETS operates in phases, with each phase lasting several years. The current fourth phase, covers the period from 2021 to 2030. It aims to achieve a 43% reduction in greenhouse gas emissions compared to 2005 levels by 2030, as part of the EU's commitment to combat climate change and meet its obligations under the Paris Agreement.

Installations that emit more greenhouse gases than their allocated allowances are required to purchase additional allowances to cover their excess emissions. Conversely, installations that emit less than their allocated allowances can sell their surplus. This creates a financial incentive for covered entities to reduce their emissions and invest in low-carbon technologies, as they can profit from selling surplus allowances or face additional costs for purchasing allowances.

The EU ETS also includes provisions to prevent carbon leakage, which is the risk of emissions and economic activities moving to regions with less stringent climate policies, resulting in no net reduction in global emissions. To address this, certain energy-intensive and trade-exposed industries may receive free allowances to prevent carbon leakage and maintain their international competitiveness.

The system is subject to continuous monitoring, reporting, and verification of emission data to ensure its integrity and effectiveness. It is managed by the European Commission and is supported by a robust legal and regulatory framework.

As a key policy instrument in the EU's efforts to mitigate climate change, the EU ETS puts a price on carbon and incentivizing emission reductions in covered sectors while promoting the transition to a low-carbon economy.

For inquiries please contact:

regulatory-advisory@rbinternational.com

RBI Regulatory Advisory

Raiffeisen Bank International AG | Member of RBI Group | Am Stadtpark 9, 1030 Vienna, Austria | Tel: +43 1 71707 - 5923