Navigating the Sustainable Finance Disclosure Regulation (SFDR) for a Greener Future

In an era when environmental and social responsibility are at the forefront of global concerns, the financial industry is undergoing a transformative shift towards sustainable finance. The European Union has taken a leading role in this endeavor, introducing regulatory frameworks such as the Sustainable Finance Disclosure Regulation (SFDR). This regulation, which came into effect in March 2021, has significant implications for the financial sector, investors, and the broader community.

The SFDR is a key component of the European Union's broader Sustainable Finance Action Plan. Its primary objective is to promote sustainability by enhancing transparency and ensuring that environmental, social, and governance (ESG) factors are integrated into investment decisions.

Under SFDR, financial market participants, including banks, asset managers, and insurers, are required to disclose detailed information about how they integrate ESG considerations into their investment processes and how these factors impact their products and services. This disclosure is intended to empower investors with the knowledge needed to make informed, sustainable investment choices.

SFDR is structured around three core pillars:

- Transparency: The first pillar focuses on transparency and disclosure requirements. Financial market participants must provide clear and consistent information on their websites and in pre-contractual documents about how they incorporate sustainability risks into their investment processes.

- Principal Adverse Impact (PAI) Disclosure: The second pillar introduces the concept of Principal Adverse Impact (PAI) disclosure. This involves reporting on the adverse effects of investment decisions on sustainability factors, such as climate change and human rights. The goal is to enable investors to assess the impact of their investments on ESG issues.

- Sustainability-Related Disclosures in Products: The third pillar pertains to sustainability-related disclosures in investment products. This includes providing information on the environmental or social characteristics of investment products and their alignment with specific sustainability objectives, such as low carbon or socially responsible investment strategies.

SFDR has far-reaching implications for both the financial industry and society at large:

- Transparency and Accountability: SFDR fosters transparency, making it easier for investors to identify financial products that align with their values and sustainability objectives. This transparency holds financial institutions accountable for their sustainability claims.

- Encouraging Responsible Investing: By requiring financial market participants to consider sustainability risks, SFDR encourages responsible investing. It shifts the focus from purely financial returns to long-term sustainability, promoting a more balanced approach to wealth creation.

- Driving ESG Integration: SFDR accelerates the integration of ESG factors into investment strategies, which is crucial for addressing global challenges like climate change, inequality, and resource depletion.

- Promoting Sustainable Development: Ultimately, SFDR contributes to the broader goal of promoting sustainable development and a greener, more equitable future.

Disclosure:

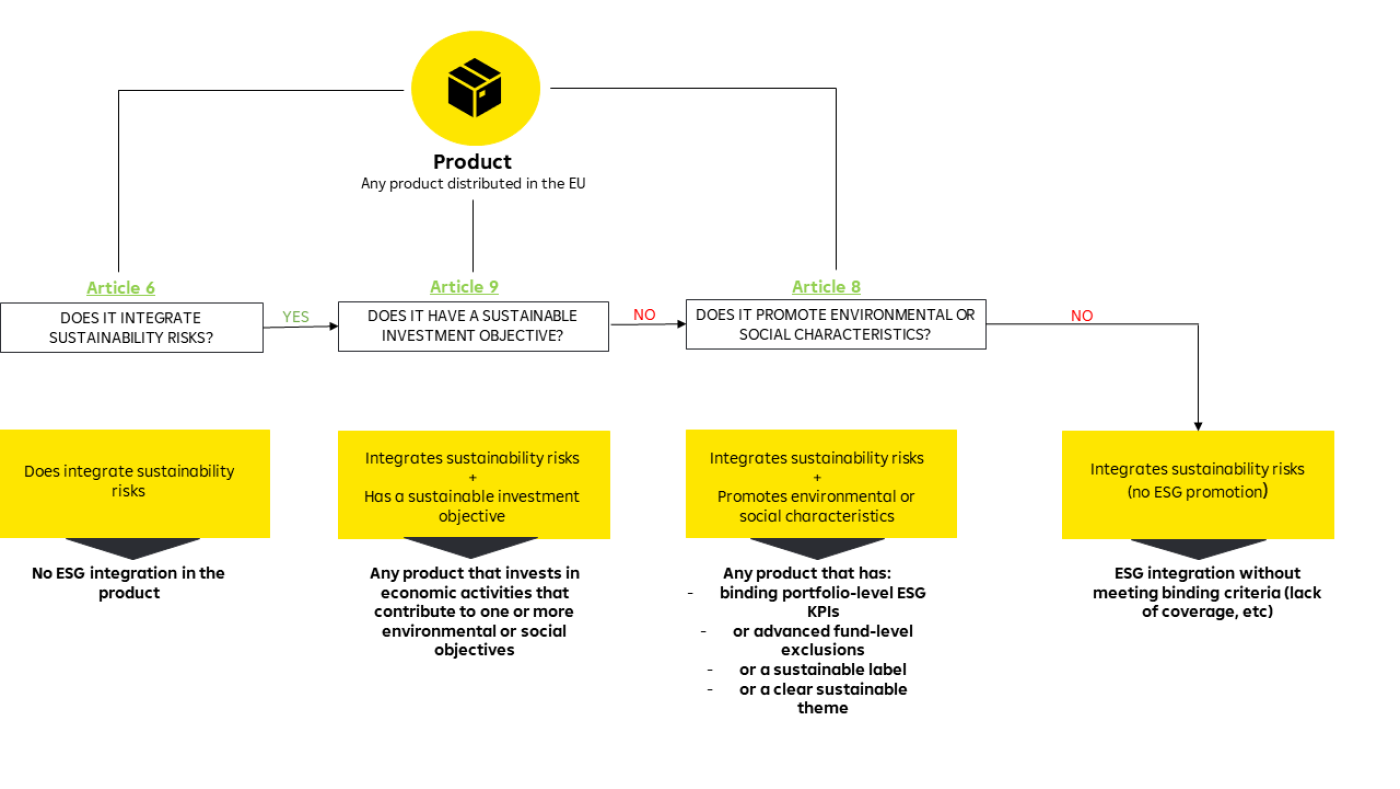

The SFDR applies to both financial market participants and financial advisors as entities, as well as the financial products they manufacture or advise on. The disclosure regime applicable to products depends on the product's classification under the SFDR framework:

- Products that pursue a sustainable investment objective fall under Article 9 of the SFDR and must adhere to the corresponding disclosure requirements.

- Products that promote environmental or social characteristics fall under Article 8 of the SFDR and must meet the respective disclosure requirements.

- Products that do not fall under either of these two articles are subject to significantly less stringent disclosure requirements.

Challenges and Opportunities

While SFDR represents a significant step forward in promoting sustainable finance, it also presents challenges for financial institutions. Compliance with the regulation's detailed reporting requirements can be complex and resource-intensive. However, it also opens up opportunities for innovation and differentiation in the market.

Financial institutions that proactively embrace SFDR and use it as an opportunity to refine their ESG strategies and products are likely to gain a competitive edge. They can attract a growing base of socially conscious investors and position themselves as leaders in the transition towards a more sustainable financial system.

For inquiries please contact:

regulatory-advisory@rbinternational.com

RBI Regulatory Advisory

Raiffeisen Bank International AG | Member of RBI Group | Am Stadtpark 9, 1030 Vienna, Austria | Tel: +43 1 71707 - 5923