ECB Climate Risk Stress Test

According to Article 100 of CRD IV, the European Central Bank (ECB) is required to conduct annual stress tests on supervised entities as part of its Supervisory Review and Evaluation Process. The test, which is part of the ECB’s wider climate roadmap, is not a capital adequacy exercise but rather a learning one for banks and supervisors alike. It collected qualitative and quantitative information, with a view to assessing the sector’s climate risk preparedness and gathering best practices for dealing with climate-related risk.

As part of its EU-wide stress tests conducted every two years, the EBA works alongside the ECB, ESRB and national supervisory authorities in order to include all the major banks that the ECB supervises directly. As part of the exercise, the EBA, the ESRB, the ECB and the European Commission develop scenarios and key assumptions jointly and publish aggregate and individual results.

For banks under its direct supervision that aren't included in the EU-wide EBA stress test, the ECB conducts its own stress test during years when the EBA conducts its EU-wide stress test. The ECB publishes the results of this test as part of its annual SREP process. The test uses EBA methodology and requires adjustments for smaller banks to allow for proportionate treatment.

A total of 104 significant banks participated in the test consisting of three modules, in which banks provided information on their:

- own climate stress-testing capabilities,

- reliance on carbon-emitting sectors, and

- performance under different scenarios over several time horizons.

To ensure proportionality, the bottom-up stress test within the third module was limited to 41 directly-ECB-supervised banks.

1. Impacts:

- Physical risk of ongoing climate change; heat, drought, flood

- Transitional risk due to changes in policies, as the economy transitions to a less carbon-intensive environment

2. Methods:

The scenario projections for climate risks and their effect on corporate balance sheets and in consequence on risk for banks required development in stress testing frameworks, in particular the transmission mechanism of the new input parameters (carbon tax, energy mix,...) needed to be accounted for.

3. Results:

- the results are published by ECB on aggregated levels, however ECB sent detailed results, benchmarking and feedback to each participating banks

- the outcome will feed into the SREP using a qualitative approach, but will not increase capital requirements in 2022, but may be included in later iterations

- the stress test is part of the ECB’s approach to follow up on its supervisory expectations as set out in its Guide on climate-related and environmental risks

4. Transition Scenarios:

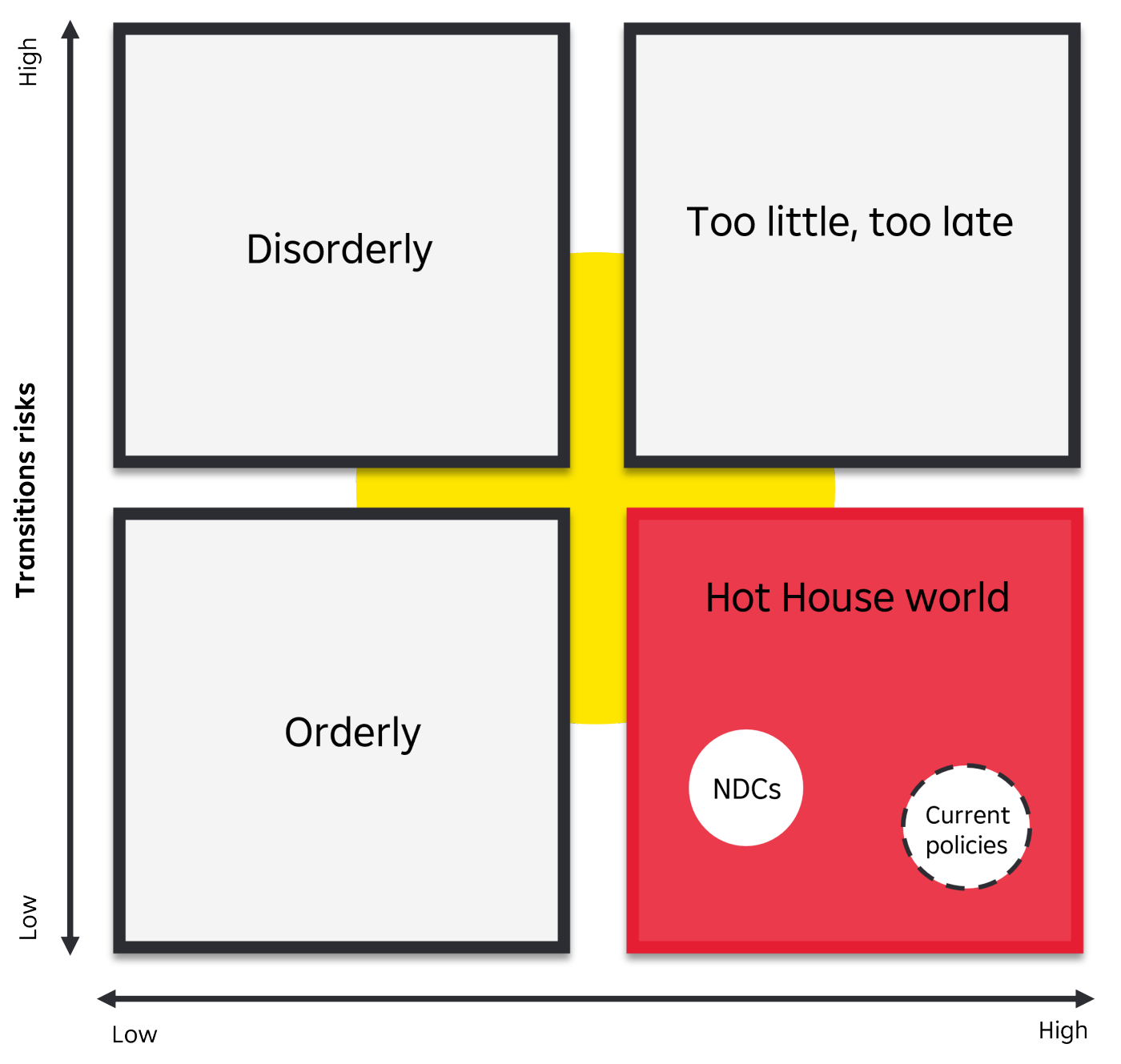

- Disorderly: sudden and unanticipated response is disruptive but sufficient enough to meet climate goals

- Too little, too late: we don’t do enough to meet climate goals, the presence of physical risks spurs a disorderly transition

- Orderly: we start reducing emissions now in a measured way to meet climate goals

- Hot house world: we continue to increase emissions, doing very little, if anything, to avert the physical risks

5. Scope:

- Module 1: Climate Stress testing capabilities

Uniform and standardized assessment of bank’s climate risk stress testing framework and data availability

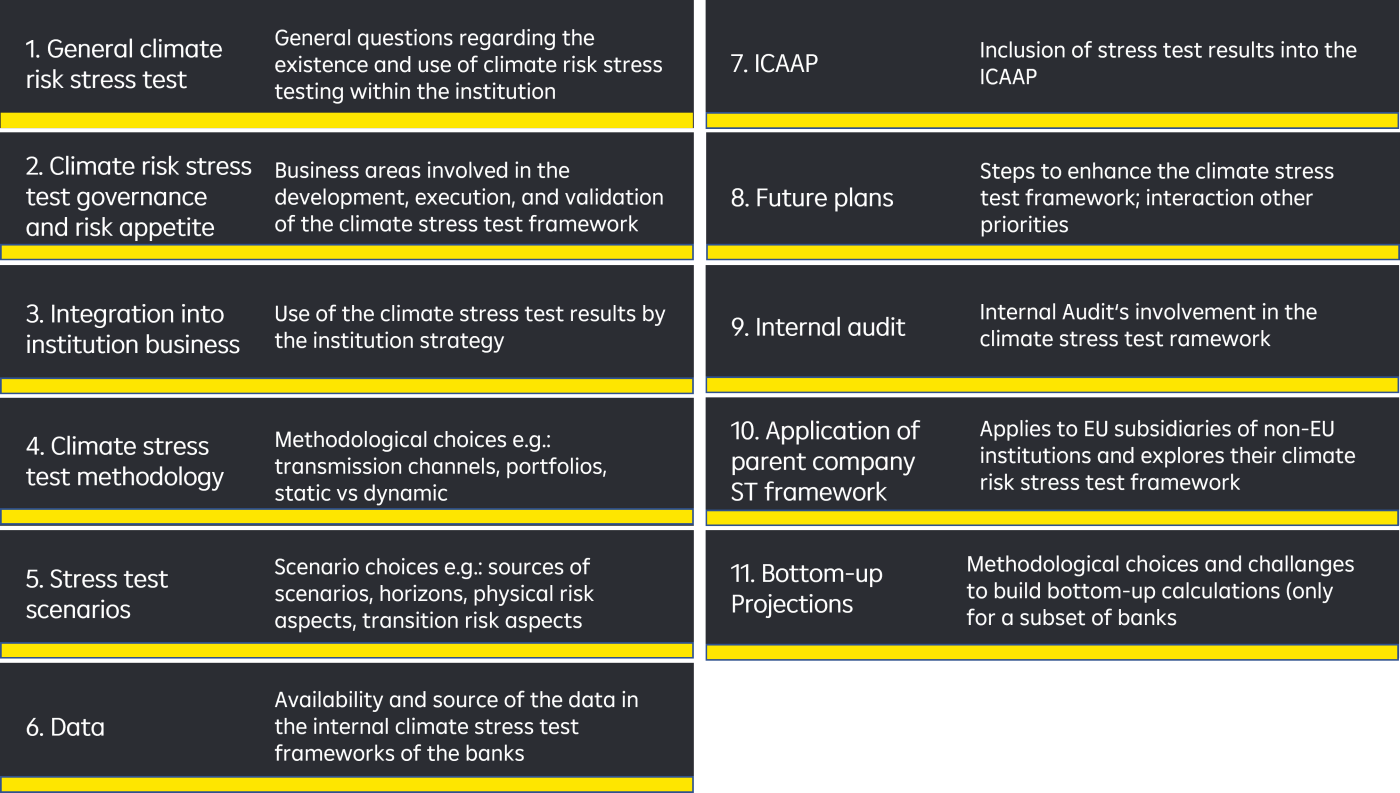

77 questions across 11 thematic areas: Governance, risk appetite, integration into business strategy, methodology, scenarios, data, ICAAP, plans, internal audit and bottom-up projections

- Module 2: Assessment of banks’ transition risk exposure Uniform methodology for two climate risk metrics:

1.) Interest, fee and commission income from greenhouse gas intensive industry sector (split by country)

2.) Financed GHG emissions (Scope 1-3) from largest non-SME counterparties per NACE sector (min. 15 counterparties per NACE sector)

- Module 3: Bottom-up stress test

(only 41 banks took part in 2022’s climate stress test, RBI was part of it)

Uniform methodology for banks bottom-up stress test projections Methodology anchored to EBA EU-wide stress test with new modeling granularity for transition risk and physical risk

6. Questions:

7. Results of the ECB’s SSM Climate Risk Stress Test 2022:

The ECB published the aggregated results of its 2022 climate risk stress test on the 8th of July 2022. 104 significant banks participated in the premiere of ECB’s climate stress tests based on the information as of the 31st of December 2021, but only 41 banks, also took part in the bottom-up climate risk stress test exercise.

Generally, the setup included three modules in which banks provided information on:

- their climate stress-testing capabilities,

- their reliance on carbon-emitting sectors and

- a bottom-up climate risk stress test to evaluate performance under different extreme weather scenarios and transition scenarios over several time horizons.

Results show that:

- Banks managed to report comprehensive and innovative information on climate risk

- Most banks do not have robust climate risk stress-testing frameworks and lack relevant data

- Stress test shows banks’ losses lower in an orderly transition scenario than after delayed action

One of the main results of module one was, that the majority of banks, 58,65%, do not include climate risk in their stress testing framework and only 20% make use of climate risk as a variable in their loan granting process.

The aggregated results of the second module showed, that 65,2% (median value) of bank’s interest income from non-financial corporates was linked to 22 carbon intensive sectors. However, often banks’ “financed emissions” came from a small number of large counterparties. Additionally, many proxies had to be used as data availability and reliance still needs to be improved across economic sectors.

The bottom-up stress test exercise showed, that across Europe, banks’ vulnerability to heat, drought or flood events is heterogenous and dependent on sectoral activities and geographical location. Where heat and drought will decrease the productivity in agriculture, construction and mining, flooding most likely will hit the real estate sector and collaterals more severely.

Overall, the results showed that banks still have a long way to go to fully align with the expectations of the ECB regarding climate risks. However, through this exercise banks could gather valuable information and make first steps in learning how to implement climate related risk in their frameworks. This is also emphasised by the fact, that the climate risk stress test results this year will only be included in a qualitative way in the SREP but will have no effect on the capital requirements.

For inquiries please contact:

regulatory-advisory@rbinternational.com

RBI Regulatory Advisory

Raiffeisen Bank International AG | Member of RBI Group | Am Stadtpark 9, 1030 Vienna, Austria | Tel: +43 1 71707 - 5923