Buffer overview in Europe. Should banks address their capital ratios in the near future?

As a follow-up to our recent article CCyB review in Europe where we highlighted the Countercyclical Capital Buffer (CCyB) in Europe, we would like to give you a broader overview of the total buffer requirements, which sum up to the:

- Capital conservation buffer (CCoB),

- Countercyclical Capital Buffer (CCyB),

- Global systemically important institutions (G-SII buffer),

- Other Systemically Important Institutions (O-SII buffer) and

- Systemic risk buffer (SyRB).

During times of stress, capital buffers enable banks to absorb losses while continuing to provide key financial services to the real economy.

The purpose of buffers is to increase banks' resilience against shocks in addition to minimum capital requirements.

The EU countries, Iceland, Liechtenstein, and Norway have one unified buffer regime, but levels mostly differ with some regional characteristics which we summarized below:

- the CCoB (capital conservation buffer) stands at 2.5% for all countries and all banks, respectively. It was introduced to ensure that banks have an additional layer of usable capital that can be drawn down when losses are incurred. It must be fully met with Common Equity Tier 1 (CET1) capital. If the buffer falls below the 2.5% capital distribution restrictions kick in for the bank until the buffer is replenished.

- the CCyB (countercyclical capital buffer) should reduce the risk of excessive credit growth during an economic boom. It can also be relaxed to relieve bank’s capital requirements in times of recession. For the vast majority of countries stands at 0%, with some exceptions such as Norway at 1%, Luxembourg at 1%, Slovakia at 1%, the Czech Republic at 0.5% and Bulgaria at 0.5%. However, just before the second half of 2023, we can see a gradual yet drastic increase in the requirement in 12 countries (see here in more detail).

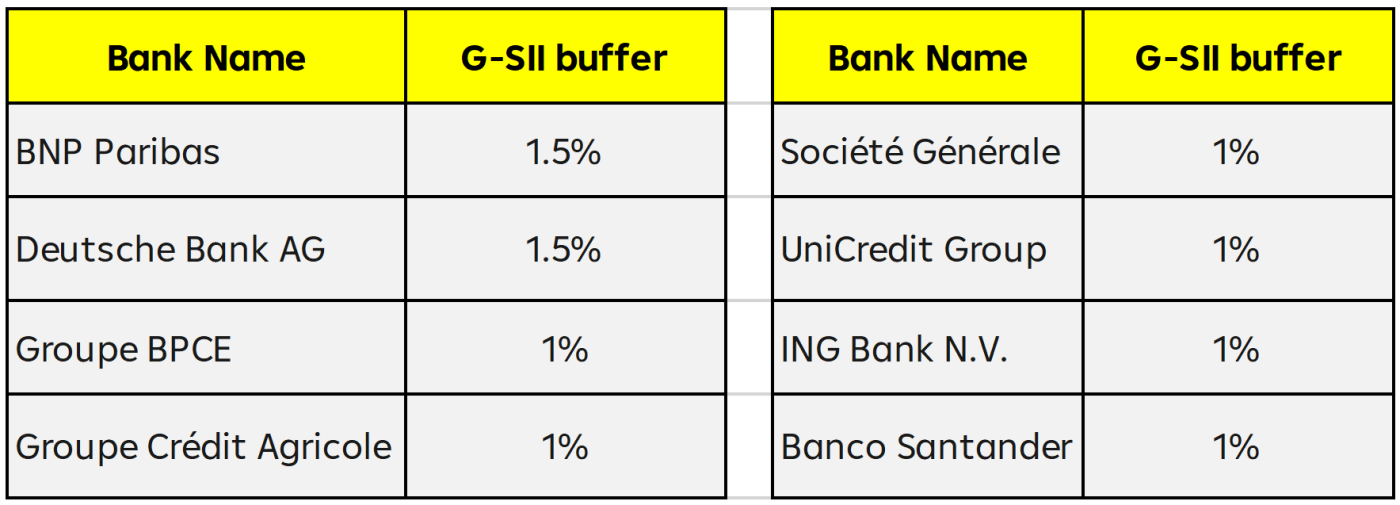

- the G-SII (global systemically important institution) buffer was one of the reactions to the “to big to fail” problem made apparent by the global financial crisis in 08/09 and introduces another capital layer to cover potential losses. However, it is very rare and applied just for specific big, global banks:

The O-SII (other systemically important institution) buffer is applied to almost all banks under ECB supervision having a range of 0% - 3%. It has the same purpose as the G-SII buffer for the other systemically important institutions. Nordic, Western, and Central European banks tend to have a higher O-SII buffer (Danske Realkreditselskab A/S -3%), while Eastern Europe tends to have a lower O-SII buffer (BluOr Bank AS 0%). Nevertheless, each bank has its own buffer requirement set by the national competent financial authority in accordance with European Banking Authority's (EBA) assessing guidelines.

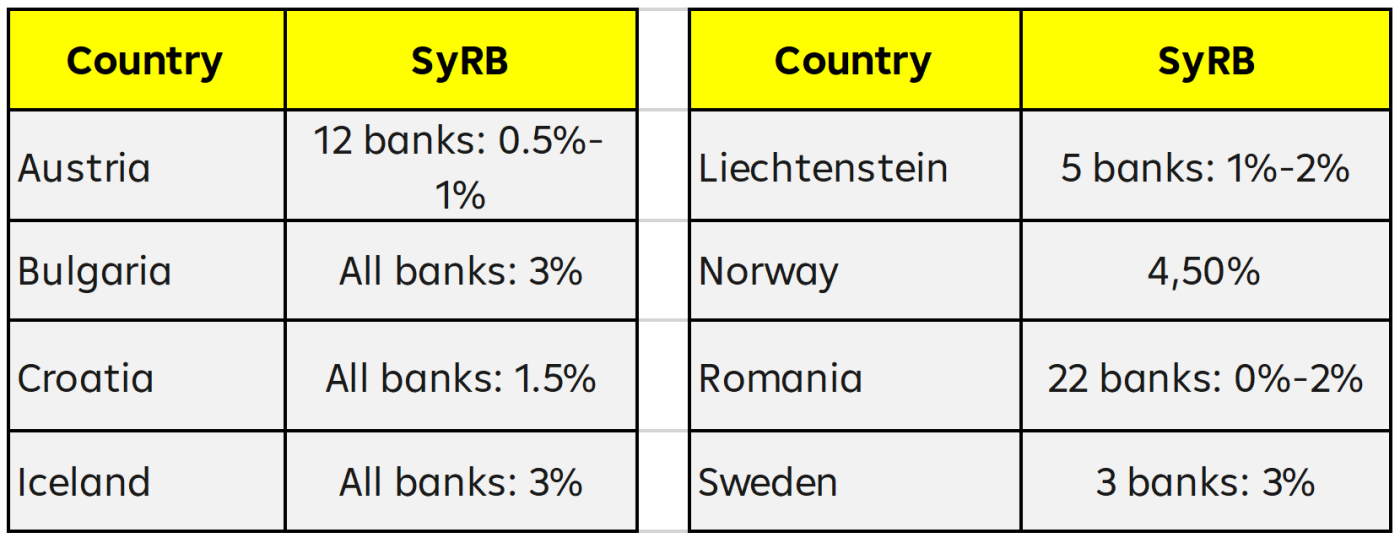

The SyRB (systemic risk buffer) was introduced to address systemic risks that are not covered by the Capital Requirements Regulation or the other buffers, it has no limit and varies from country to country. It is present only in 8 countries, having a range of 0% - 4.5%.

The sum of all buffers described above is called the Combined buffer requirement (CBR), which varies from 2.5% in Hungary to 10,5% in Norway, with a common range of 2.5%-4.5%.

Looking at future developments, we can see tendencies to increased buffer requirements on the one hand, but on the other hand economic forecasts also show a potential economic downturn which would put additional pressure on banks. The biggest impact will be the increase of CCyB in twelve countries and the O-SII increase for four banks from Slovenia and Finland. The overall picture shows that a buffer increase needs to be properly addressed in a bank’s financial planning activities and might result in reviews of the target capital ratios especially in times of a volatile economic environment.

For inquiries please contact:

regulatory-advisory@rbinternational.com

RBI Regulatory Advisory

Raiffeisen Bank International AG | Member of RBI Group | Am Stadtpark 9, 1030 Vienna, Austria | Tel: +43 1 71707 - 5923