Prudential MDA buffer bucket approach & overview in Europe

As promised in the last MDA buffer article, we will elaborate a bit more in detail on the bucket approach when it comes to the Maximum Distributable Amount (MDA) of credit institutions.

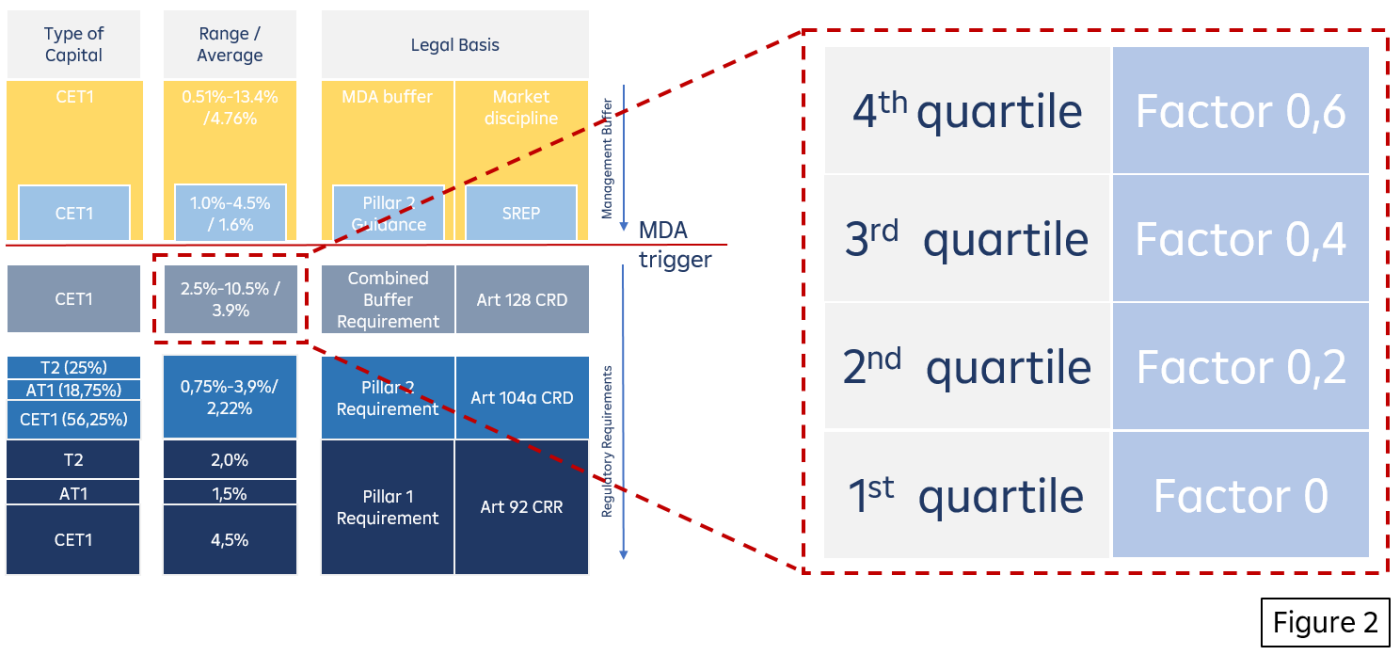

The question is: what happens if the prudential capital level falls (or is expected) to fall below the MDA trigger line and reaches the Combined Buffer Requirements (CBR)? Are variable distributions forbidden immediately, or are there still some variable payments allowed?

In general, the answer is yes, given certain prerequisites are fulfilled, credit institutions still might payout variable distributions even if their capital levels are below the MDA trigger line, i.e. are in general critical from a supervisory point of view.

So let us go through two simplified steps on Article 141 CRR, restrictions on distributions, and see how this is possible:

In a first step: variable payments by credit institutions are generally limited if the Common Equity Tier 1 (CET1) of the bank is at a level that is not meeting the CBR anymore. To visualize this, it would happen if the capital level arrives at a level lower than the MDA trigger line in figure 2 on the left side.

In a second step: the institution that fails to meet the CBR faces restrictions for variable distributions but may still be allowed to payout any (interim) profits not yet accounted in the regulatory capital base depending on the quartile in which the CBR breach occurs:

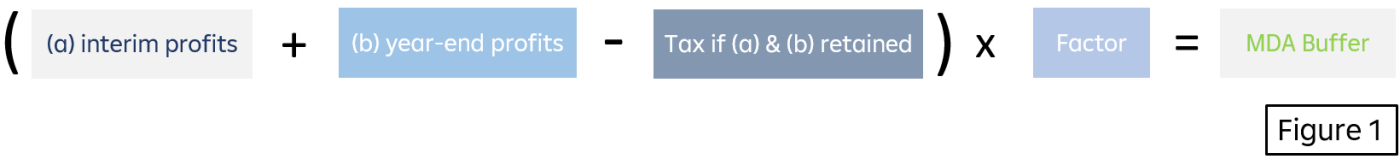

Sum of (a) interim profits and (b) year-end profits which are not yet included in the CET1, minus (c) amounts that would be payable by tax (if the items specified in points (a) and (b) to be retained), multiplied by the factor.

The factor represents a percentage of 0%, 20%, 40% or 60% based on what quartile (CBR/4) the CET1 capital level is (figure 2). That means the banks would still be allowed to pay variable distributions from any profits not yet accounted in the CET1. There is a notification requirement towards the competent authority and a special approval process included in the CRR for such situations.

How does the bucket approach work?

CBR is split into four quartiles, depending on in which quartile (CBR/4) of the CBR the capital levels are, the factor is then applied in the MDA buffer calculation (figure 1). If the level is in the 1st quartile meaning the capital level is very critical, 0% is applied for determining the MDA, and consequently, no distributions are allowed at all.

However, if the capital level is in the 4th quartile, 60% of not yet accounted profits (in the CET1), can be used for further variable distribution by the credit institution. The same will be applied for the 2nd and 3rd quartile with a factor of 20% and 40% respectively.

MDA buffer overview in Europe

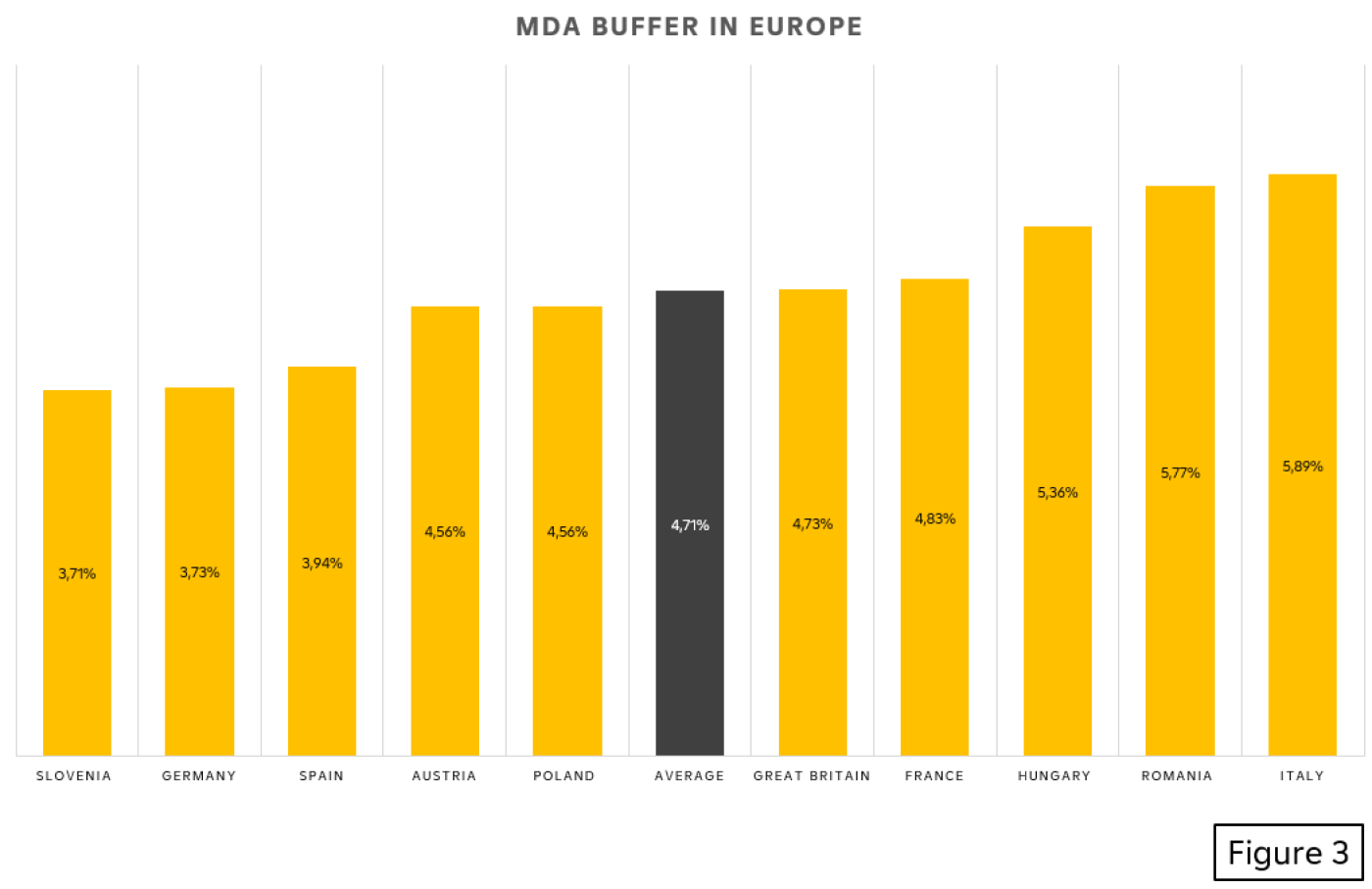

Based on an analysis done internally at RBI (Figure 3 [1]), we can see that based on the sample, the average MDA buffer is at 4,7%, which is above the average Pillar 2 Guidance of 1,6%.[2] What needs to be considered in this respect is, that in many countries the buffer requirements are expected to increase, leading to a higher CBR. This is driven on the one hand by increasing countercyclical buffer rates in some countries and increase other macro-prudential buffers like the systemic risk buffer and the other systemically important institution buffer. As a result, we might see here a tightening of the average capital situation in the near future depending on the organic capital generation capabilities of EU banks connected with the macro-economic environment and associated risks.

[1] Analysis based on 54 banks from 10 countries in Europe, 3 to 10 banks are taken per country, and the average is made taking recently available data (can be 2021 or any reference point throughout 2022).

[2 ]Range based on the minimum requirement possible and the maximum requirement in 2021, source: Pillar 2 Guidance

For inquiries please contact:

regulatory-advisory@rbinternational.com

RBI Regulatory Advisory

Raiffeisen Bank International AG | Member of RBI Group | Am Stadtpark 9, 1030 Vienna, Austria | Tel: +43 1 71707 - 5923