ESG regulatory landscape in Europe

In recent years, Europe has become a leader in implementing ESG (Environmental, Social, and Governance) regulations. These regulations promote sustainable finance and investment practices and align business objectives with societal and environmental goals. This article will explore the background of ESG regulation in Europe, its impact on businesses, and the future of sustainable finance in the region.

Background:

The origins of ESG regulation in Europe can be traced back to the Paris Agreement on climate change, signed in 2015. The agreement aims to limit global warming to well below 2 degrees Celsius and to pursue efforts to limit the temperature increase to 1.5 degrees Celsius above pre-industrial levels. To fulfill this goal, the European Commission published a strategy for a climate-neutral Europe by 2050, the European Green Deal.

The European Green Deal, announced in December 2019, is a significant initiative to reach a more sustainable and climate-neutral economy. The Green Deal outlines a comprehensive plan to transform the EU's economy. Key objectives include reducing greenhouse gas emissions, increasing renewable energy use, and promoting sustainable agriculture and circular economy practices.

As part of the Green Deal, the European Commission established the Sustainable Finance Action Plan in 2018, focusing on mobilizing capital for sustainable investments and ensuring that ESG considerations are integrated into the financial system. The Action Plan includes several key measures, such as developing a taxonomy for sustainable investments, creating EU sustainability standards, and establishing a green bond standard.

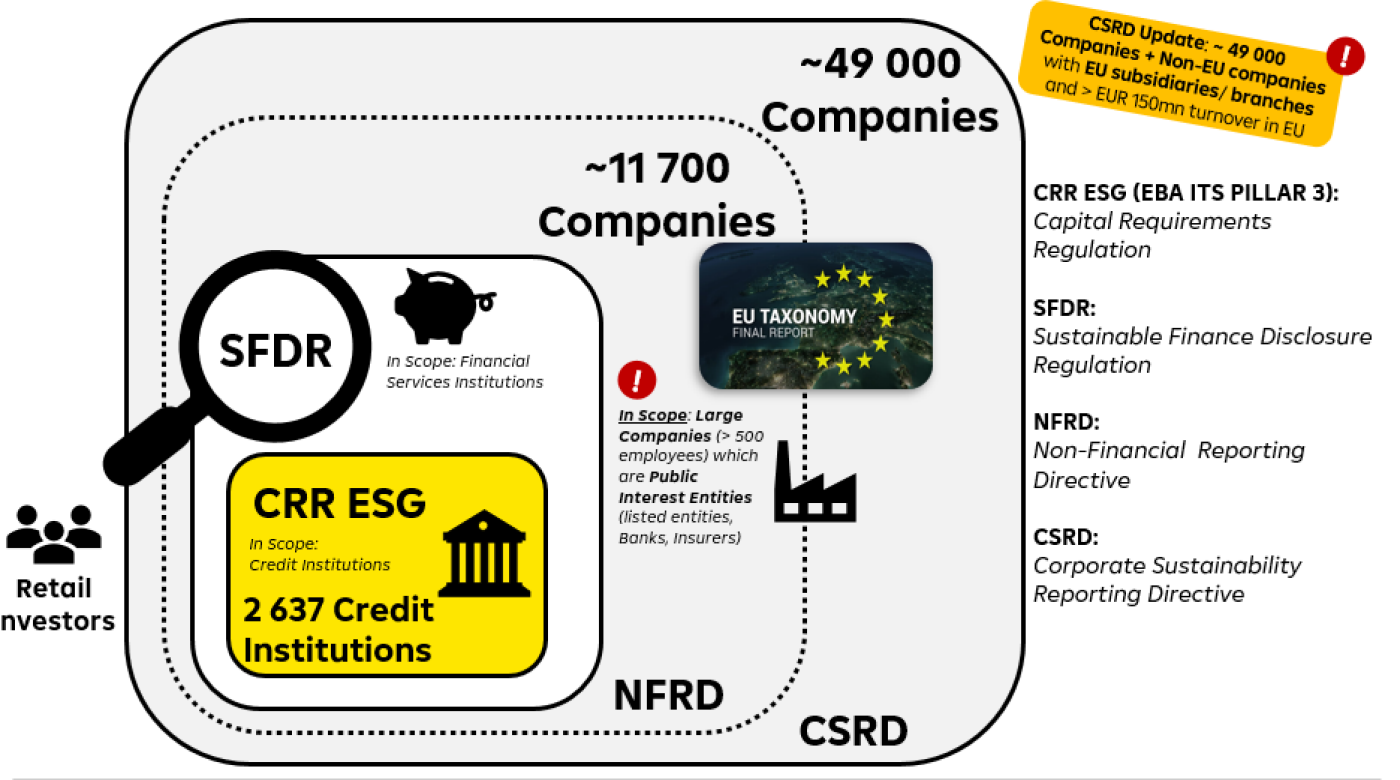

This article will briefly explore five key ESG regulations in Europe: the Non-Financial Reporting Directive, the Corporate Sustainability Reporting Directive, the EU Taxonomy, the Sustainable Finance Disclosure Regulation, and the ESG requirements in CRR.

The Non-Financial Reporting Directive (NFRD) was introduced in 2014 to increase transparency and encourage companies to report on ESG issues. Large public-interest entities with over 500 employees must disclose information on their policies, risks, and goals related to environmental protection, social responsibility, and human rights. Companies affected by this regulation must disclose relevant information in their annual reports.

The Corporate Sustainability Reporting Directive (CSRD), which entered into force in December 2022, builds on the NFRD by expanding the scope of reporting requirements. It will require all large companies, listed SMEs, and all non-EU companies with subsidiaries/ branches in the EU and an EU turnover of > EUR 150m to report on their sustainability activities, including their impact on the environment, social issues, and governance practices. The directive also requires new reporting standards, European Reporting Standards (ESRS), making it easier for investors to compare information across companies and make informed investment decisions.

The EU Taxonomy is a classification system developed by the European Union to define which economic activities can be considered environmentally sustainable. The EU Taxonomy focuses on six environmental objectives:

- climate change mitigation,

- climate change adaptation,

- sustainable use and protection of water and marine resources,

- transition to a circular economy,

- pollution prevention and control and

- protection and restoration of biodiversity and ecosystems.

It sets out criteria for a substantial contribution to one or more of its goals, as well as technical screening criteria for the so-called "Do No Significant Harm" principle. It also requires observance of the minimum social safeguards for an activity to be considered sustainable (EU Taxonomy aligned). The taxonomy applies to producing industries and various financial sectors, including investment funds, pension funds, insurance, or financial institutions.

The Sustainable Finance Disclosure Regulation (SFDR) is a set of regulations promoting sustainable investments in the financial sector. Financial market participants must disclose information on how they integrate ESG factors into their investment decisions and manage sustainability risks. Companies affected by this regulation must ensure that their investment strategies and decision-making processes align with the ESG goals set out in the regulation.

It also introduced disclosure requirements for article 6, 8 (light green) and 9 (dark green) funds.

CRR ESG Requirements

Under the CRR ESG Requirements, banks and other financial institutions must

consider ESG risks in their risk management processes and disclose how they

manage these risks to regulators and investors. The regulation promotes sustainable finance and reveals the financial sector's resilience to ESG-related risks. The CRR ESG requirements include the following:

- assessing and measuring ESG risks in credit and investment decisions,

- incorporating ESG risks in stress testing and scenario analysis,

- disclosing certain KPIs, like the Green Asset Ratio (GAR, BTAR)

- disclosing ESG-related information to investors and the public (e.g. Scope 3 Emissions).

Overall, these regulations will significantly impact companies operating in Europe. Companies affected by these regulations must implement new reporting procedures and systems to ensure compliance. They will also need to consider ESG factors in their decision-making processes and align their activities with the ESG goals set out in the regulations. Failure to comply with these regulations can result in fines and reputational damage, significantly impacting a company's bottom line.

However, compliance with these regulations can also bring benefits to companies. Companies that are transparent about their ESG activities and risks can build trust with stakeholders, leading to increased investment and customer loyalty. Companies that align their activities with the ESG goals set out in the regulations can also benefit from access to sustainable financing and increased opportunities for growth and innovation.

Source: European Commission

Are you looking to learn more about the rapidly evolving EU-ESG landscape and how it may impact your company? Our team of experts is here to help. Contact us to learn more about our services and how we can help your company stay ahead of the curve in the ever-changing EU-ESG landscape.

For inquiries please contact:

regulatory-advisory@rbinternational.com

RBI Regulatory Advisory

Raiffeisen Bank International AG | Member of RBI Group | Am Stadtpark 9, 1030 Vienna, Austria | Tel: +43 1 71707 - 5923